UNDER ISLAMIC FINANCE, YOU HAVE TO PAY FULL SELLING PRICE NO MATTER WHAT.

![]()

One of the misconceptions that plague the Islamic Banking financing in Malaysia is that once the Customer agrees on a price in an Aqad (Offer and Acceptance of Sale & its Terms), there is no backing out of the Selling Price and other considerations. If a house at current Value of RM400,000 (Principal) is purchased from a Bank at a Selling Price of RM1,000,000 to be paid in instalments over 35 years. This means the profit earned by the Bank over 35 years is RM600,000. The misconception is that when the Customer intend to Sell-Off or Pay-Off the financing in let’s say Year 8 of 35, the whole amount of RM1,000,000 must be paid to the Bank due to the concluded Aqad, where RM1,000,000 is contracted. So, if at year 8 the Customer has paid a total instalment of RM110,000, the remaining RM890,000 is still payable by the Customer. Whereby the Principal Outstanding for the Financing is RM320,000 in this scenario.

For a Conventional Loan, the amount payable is the Principal Outstanding of RM320,000 + any interest outstanding (earned but not yet paid) + any early settlement penalties.

(The above figures are for illustration only. For a more accurate calculation, scroll down to the examples below)

SETTLEMENT OF THE SELLING PRICE.

Because of this misconception, a lot of Customers think that a Shariah-compliant financing is More Expensive than the Conventional Loan. This is just a half-truth. While the Selling Price Outstanding is RM890,000 as contracted in the Aqad, Islamic Banks are required to provide “Rebates” (Ibra’) on the Selling Price Outstanding to be fairer to the customer. Although entitled to earn the full amount of Selling Price from the Aqad, a Rebate on the Selling Price should always be given.

HISTORY OF GIVING REBATES

Traditionally and by nature, Rebates are discretionary on the financier, to be given to the Customer as the Aqad allow for the collection of the full contracted Selling Price. To achieve parity with the Conventional Loans, Islamic Banks have opted to give rebates on the Selling Price, based on their discretionary calculations. This may include early settlement penalties or other charges, which improves the Bank’s profit ratio. This has resulted in inconsistencies to the amount of rebate given; one Bank may charge differently to another.

MAKING REBATES MANDATORY

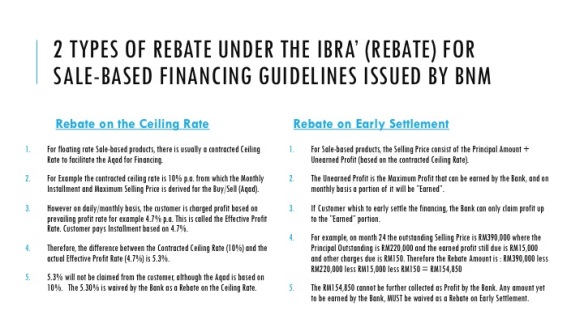

BNM issued a Guideline for Rebate (Ibra’) for Sale-based Financing in 2011 to address this inconsistent practice by making it MANDATORY (not discretionary) for Islamic Financial Institutions to provide rebates under specific scenarios. Under the guidelines, a specific formula is given for 2 scenarios where rebate may arise:

- Rebate arising from differences between the contracted Ceiling Profit Rate (CPR) and the Effective Profit Rate (EPR).

- Rebate arising from the waiver of Unearned Profit due to Early Settlement of Financing.

REBATES ON THE CEILING RATE

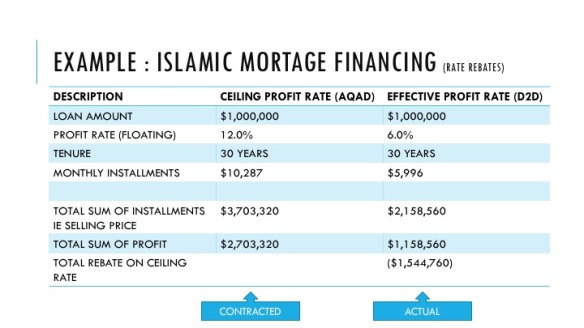

This is applicable where the structure allows for pricing based on floating-rate, usually prevalent for long term structures such as a 30-year home financing. The structure allows for the customer to be charged based on a floating rate ie prevailing market rate which moves in tandem with the various base rate benchmarks. The benchmark can also be a conventional pricing rate that moves with the market. For example, the prevailing rate consists of a Base Rate of 4.05% + Margin of 1.45%, giving us an effective rate of 5.50% pa.

Therefore:

- Financing Amount : RM1,000,000

- Base Rate : 4.05% (moving rate)

- Profit Margin : +1.45% (fixed or movable based on event)

- Effective Profit Rate (EPR) : 5.50%.

- Tenure : 3 years

- Instalment Amount (EPR) : RM30,195.90 per month

However, for the purpose of Aqad, all the terms must be agreed upon execution and perfection of Aqad. If the Rates are moving, how can all the rates be agreed upon up-front? Thus there is a need to agree on one Rate where Islamic Banks can conclude the Aqad with an agreed-upfront Selling Price. To conclude the Aqad by formalising the Selling Price, the following is required.

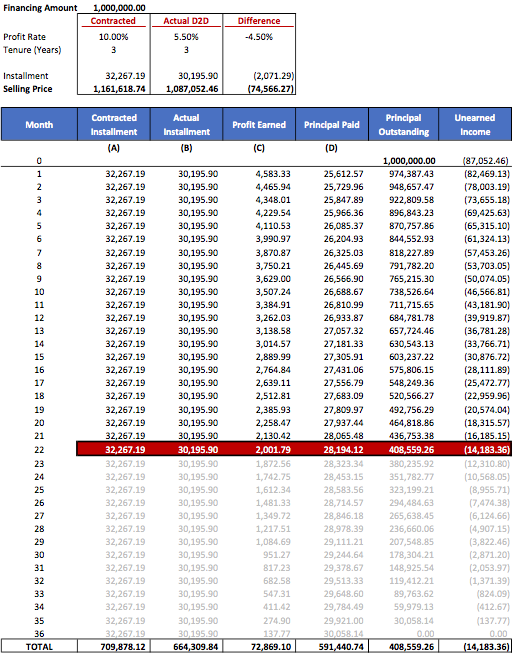

- Financing Amount : RM1,000,000

- Base Rate : 4.05% (moving rate)

- Profit Margin : +1.45% (fixed or movable based on event)

- Effective Profit Rate (EPR) : 5.50%.

- Tenure : 3 years

- Instalment Amount (EPR) : RM30,195.90 per month

- Maximum Ceiling Profit Rate (CPR) : 10.0% (fixed)

- Installment Amount (CPR) : RM32,267.19 per month (unchangeable if higher than 10.0%)

- Maximum Selling Price (CPR) : RM1,161,618.74 (unchangeable if higher than 10.0%)

Therefore, for the purpose of Aqad, where every detail needs to be agreed upfront, the following is used:

- Financing Amount : RM1,000,000 (fixed)

- Tenure : 3 years (fixed)

- Maximum Ceiling Profit Rate (CPR) : 10.0% (fixed)

- Installment Amount (CPR) : RM32,267.19 per month (unchangeable if higher than 10.0%)

- Maximum Selling Price (CPR) : RM1,161,618.74 (unchangeable if higher than 10.0%)

And for the purpose of day-to-day charge of Instalment and Profits, the following applies:

- Financing Amount : RM1,000,000

- Base Rate : 4.05% (moving rate)

- Profit Margin : +1.45% (fixed or movable based on event)

- Effective Profit Rate (EPR) : 5.50%. (moving rate)

- Tenure : 3 years (fixed)

- Instalment Amount (EPR) : RM30,195.90 per month (changeable based on EPR or events)

This means, the Aqad we have contracted is based on CPR of 10%, but on day-to-day basis, the EPR is 5.50%. Therefore, Rebate on the Ceiling Profit Rate is:

10.00% less 5.50% = 4.50%

In value, the monthly rebate is RM2,071.29 and TOTAL rebate based on Price is RM74,566.27

REBATE ON EARLY SETTLEMENT

The second element of misconception was what mentioned earlier. That to early settle you have to pay ALL the remaining balance of the contracted Selling Price. This proved to be a major contention by customers, although it is NOT TRUE in Malaysia.

Mandatory Rebate must be given in the following early settlement scenario, and a penalty for early settlement cannot be imposed as it will be deemed as trying to earn additional profit on top of whatever profit is rightfully yours. Upon early settlement, the Unearned Income or Profit must be waived from being charged to the customer. A Bank can therefore claim profit that is rightfully theirs ie “earned”.

The scenarios where mandatory Rebate must be given are:

- Financing when early settlement has occurred including from prepayments

- Financing where there is a restructuring into a new financing contract

- Financing settlement in cases of default

- Financing settlement where the customer cancels or terminates the financing before maturity date.

Looking at the above example, the illustration is as follows:

- Principal Amount : RM1,000,000

- Selling Price : RM1,161,618.74

- Total Profit : RM600,000

- Tenure : 3 Years

- Early Settlement Date : Month 22 of 36 months

- Total Instalment Paid as at Month 22 : RM664,309.84

- Outstanding Selling Price on Month 22 : RM497,308.90

- Outstanding Principal on Month 22 : RM408,559.26

- Earned Profit Not Paid on Early Settlement Date : RM2,001.79

- Unearned Profit Outstanding on Early Settlement Date : RM14,183.36 (AS REBATE)

Therefore for Early Settlement, the numbers are:

Early Settlement Amount is RM485,127.69 on Month 22 i.e Outstanding Selling Price (+RM497,308.90) less Unearned Profit Outstanding on Settlement Date (-RM14,183) plus Earned Profit Not Yet Paid on Early Settlement Date (+RM2,001.79). This amount is at par to what a Conventional Loan figure for Early Settlement would be. In fact, in some circumstances, a Conventional Loan figure may include additional Early Settlement Penalties that generally are not allowed under an Islamic Banking financing.

EARLY SETTLEMENT PENALTIES

In essence, Islamic Financing is govern by the understanding that debt must be settled (debt cannot be forgiven) and efforts to repay debts early should not be taken as opportunity to earn additional returns. If actual cost is incurred from the early settlement of the debt, that cost can be recovered but not additional income. Under the Ibra guidelines, it allows the Banks to charge reasonable estimates of “Actual Costs” incurred if early settlement is made within a “lock-in period” based on the following conditions:

- Costs that has not been recovered arising from a discount element in a specific period in the financing. For example, the Bank offers a Home Financing rate of 1.88% p.a. for the first 2 years and BR+1% thereafter. The reasonable costs in this case is the differential between BR+1% less 1.88% ie the shortfall from the promotional period against normal board rates.

- Cost borne by the Bank during initial stages of the financing for example Legal Fees absorbed by the Bank. If the package offers a Zero-moving cost solution, it means the Bank pays the legal and stamping fees for the customer to move from the other Bank. The cost will be recovered by the Bank.

Consequently, any reasonable costs incurred by the Bank as a direct result of the Early Settlement can be considered to be recovered by the Bank. The Shariah Committee of the Bank can take into consideration to approve the request to charge such fees, based on acceptable justification. This includes any “break funding costs” incurred by the Bank.

CONCLUSION

The common perception is that for Islamic Banking products in Malaysia, the Selling Price (which includes future profits ie Unearned Income) must be paid to early-settle an Islamic Financing is inaccurate. Currently, there are provisions to waive the unearned profits from the final settlement amount as guided by BNM. In essence, the settlement amount should consist of only the Outstanding Principal Amount + any due amount or earned amount still outstanding on the settlement date. This means, the settlement amount for Islamic Financing is NOT more expensive than a conventional loan, and in some cases, is even cheaper than the conventional settlement amount.