By Dr. Rosana Gulzar Mohd

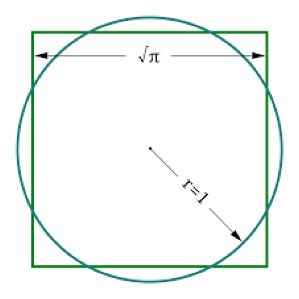

Have you heard of a round square? That is Islamic Banking in a Commercial Bank! An impossible fit. All these issues we have with Islamic banking stem from one fundamental mismatch. The banking model. Islamic Banking was supposed to be based on values such as mutuality, participativeness and a care for social welfare. Early scholars such as Umer Chapra and Nejatullah Siddiqi thus called for a system that is based on the sharing of profits and losses (PLS) to replace riba. PLS is argued to reflect Islamic principles better than debt financing because it distributes wealth based on effort and encourages communal work vs. exploitations for individual gains. Therein lies the heart of the issue: In adopting the Commercial Banking model, Islamic Banking has shied away from PLS and become just like the debt-churning, profit-driven vampire squid of a machine it was supposed to replace. I argue that the values of mutuality and participativeness are better lived through another banking model, the cooperative banks.

What is Commercial Banking and why do I have such an issue with it for Islamic Banking? As you can see in the table below, the problem with Commercial Banking begins from the way it is structured. Being shareholder-owned, the banks’ main reason for existence is to make the most money for owners. This translates into the people they hire and the products they sell. Worse, conventional banks (another name for commercial banks since they are the dominant form of banking in most parts of the world) make their money from interest or riba. It is such easy money that the banks will call customers to take up their loans. As part of the mandate to protect shareholder monies, the banks may also require guarantees or collaterals that they can confiscate should customers fall behind the payments.

What is Commercial Banking and why do I have such an issue with it for Islamic Banking? As you can see in the table below, the problem with Commercial Banking begins from the way it is structured. Being shareholder-owned, the banks’ main reason for existence is to make the most money for owners. This translates into the people they hire and the products they sell. Worse, conventional banks (another name for commercial banks since they are the dominant form of banking in most parts of the world) make their money from interest or riba. It is such easy money that the banks will call customers to take up their loans. As part of the mandate to protect shareholder monies, the banks may also require guarantees or collaterals that they can confiscate should customers fall behind the payments.

Comparison: Cooperative vs. commercial banks

| Features | Cooperative | Commercial bank |

| Owned by | Members who are also depositors and borrowers | Shareholders who are not directly involved in the business |

| Core business | Basic banking: Deposits and lending | While deposits and lending is also a main business, commercial banks, especially the larger, cross-border ones, have expanded into risky investment products such as structured deposits for wealthier customers |

| Business goals | · Dual-bottom line – financial and social objectives

· Accumulate capital for intergenerational endowment · Provide services eg lending which may be at below market rates |

· Profit-maximisation is central to the business model

· Increasing return on equity and market capitalisation for shareholders · To provide products and services which are profitable |

Source: Author, TIAS School for Business and Society of Tilburg University. (2015). Governance of European Cooperative Banks: Overview, Issues and Recommendations.

This is the ‘square’ that the ‘round’ Islamic Banks have been fitted into. So although Islam encourages a range of objectives that include communal welfare and profit-making (Note: NOT profit-maxisiming), Islamic Banks, as Commercial Banks, are almost single-mindedly pursuing the highest profits they can make for shareholders. They do this through all kinds of loans that look eerily like the riba they are supposed to replace. This is the outcome of a decision made by a group of founders in the Gulf Cooperation Council (GCC) countries in the 1970s. They wanted to quickly absorb the people’s newfound wealth from the oil boom. Several earlier attempts at genuine PLS in Egypt failed so the fastest build-up for Islamic banking would be by replicating conventional finance.

We are still paying the price because the main workhorse of ‘Islamic’ banks in this 21stcentury is loans manufactured through ‘shariah-compliant’ tawarruq or commodity murabaha. Its resemblance to riba and hilah, which are tricks used to circumvent the Shariah prohibitions, made it a bone of contention among scholars, some of whom declared it outright impermissible (OIC’s International Islamic Fiqh Academy) while AAOIFI allowed its use under stringent measures and as a transitionary tool towards genuine Islamic Banking. Now, however, tawarruq has taken over most of the operations. There is of course, a range of contracts used by ‘Islamic’ banks. Other structures such as ijarah (leasing) look pretty Shariah-compliant on the surface but on closer look, it becomes clear that they too have been bent to fit the riba-based, profit-maximisation model of commercial banking.

Put together, this means that although we have an ‘Islamic’ Banking industry, we cannot be further from the ideals of mutuality, participativeness and a care for social welfare espoused by the early scholars of Islamic Economics. This also means that despite the advent of ‘Islamic’ Banking, we continue to be caught in a rut of wealth inequality, lack of social mobility and safety nets for the poor. My research also found that the incompatible model has caused ‘Islamic’ Banks in five major Islamic finance countries, including Malaysia, to be less stable than their conventional counterparts.

Why are ‘Islamic’ Banks averse to genuine PLS?

So why are ‘Islamic’ Banks averse to genuine PLS? Yes, there are seemingly ‘musharakah’ and ‘mudarabah’ products in the market. Malaysia’s retail investment accounts are a case in point. But based on Bank Negara Malaysia (BNM)’s latest, 2018 Financial Stability and Payment Systems (FSPS) Report, investment accounts as a percentage of total deposits have been declining since 2016, after an initial burst in 2015. Further, BNM itself conceded in its 2016 FSPS Report that tawarruq transactions, arguably the benchmark for the industry’s unIslamicness, have more than doubled between 2014 and 2016. So if PLS is a gauge of the industry’s Islamicness, are we progressing or regressing?

The reason I believe, for ‘Islamic’ banks’ aversion to genuine PLS, is the wrong model that they are in. Genuine PLS requires painstaking efforts to understand customers’ capacities which are linked to their aspirations, fears and lifestyles and a clever enough system to combat the notorious problems of information asymmetry and moral hazard that have plagued PLS financings. In academia, information asymmetry refers to the possibility that banks may be abused by borrowers because they know better the reasons and results of financing. This can then lead to problems of moral hazard and adverse selection, which is the risk that banks may underprice their products for customers who in actual fact, are of high risk and vice versa. It is not in the interests of Commercial Banks, with their profit-maximisation mandates for shareholders, to invest in this form of financing when they can make easy and quick money through arms-length, collateral-backed riba financing.

In a true Islamic Bank, the loans, or ‘assets’ as they are called in Banking because they generate income forthe bank, can be supported by savings from customers. So true Islamic Banks should actually inculcate prudential financial habits that are starkly different from the consumeristic, debt-fuelled cultures perpetuated by riba-based commercial banks. True Islamic Banks should encourage us to save, buy only what we need and fix things that are broken. These are the sunnahs of Prophet Muhammad, peace be upon him, as well as the dictates of our religion.

So the litmus tests, I believe, for an Islamic Bank are the following:

- Are the Banks doing truckloads of tawarruq genuine PLS?

- Are the Banks encouraging us to take debts?

- Are the Banks goading us to spend more by for example, tying up with a shop that encourages different bajus and tudungs for every season?

Given its values of mutuality and care for social welfare, Islamic Banking is for everyone including the downtroddens in society whom commercial banks shun because they are too costly and cumbersome to deal with. Truth be told, this group of people also need support in terms of inculcating confidence, discipline and management skills. Arms-length, indifferent forms of financing as per riba or its distant cousin, the tawarruq, makes too easy use of them. The form of banking for this group of people needs to be cognisant of their state and the support they need. This, I believe, should include a comprehensive risk mitigation system that ‘encourages’ repayments. In my studies, I discovered a lesser known banking model that I believe can uphold better the Shariah values of mutuality, participativeness and a care for social welfare. And that is Cooperative Banking. Its circumference is a better fit for our Islamic Banking than the cold ends of a square. InshāAllah, we will explain this inspirational banking model at greater length in the following articles.