The Islamic Financial Services Act (IFSA) 2013 was introduced to streamline the Islamic Banking definitions and practices. With the introduction of this Act, we obtained clarity on many matters, but not all of it is in our favour. From the Act, we see a significant re-defining of the Deposit product. Needless to say, the Islamic Banking industry is at arms on this new definition.

But to classify it as a new definition is also not entirely accurate. We have been taking in Mudaraba-based deposits as our main method of accumulating deposits in the Bank. Mudaraba by nature is profit-sharing investment arrangement for the purpose of obtaining a return. Any profits arising from this investment will be shared amongst the entrepreneur and the capital provider based on agreed ratio; whereas for any losses, it will be borne by the capital provider, unless the entrepreneur is proven negligent. In all intent and purposes, this is an investment, rather than deposits.

However, while there is a risk to the investment, this is mitigated by way of investing in low risk intruments, profit equalisation or even gift (hibah) to ensure a customer’s capital is not lost. Technically an investment, but with indirectly guaranteed capital due to the above mechanisms. Furthermore, this is augmented with the deposit insurance offered by the Malaysian Deposit Insurance Corporation (PIDM) which insures the customer’s deposit with the Bank, should a Bank goes belly-up.

With such assurances, Banks have taken these Mudaraba placements as “Deposits”, categorised internally as part of the Core Deposits calculations i.e. low risk deposits. Why this is important is because if you have higher Core Deposits in your books, you can therefore fund a higher proportion of your financing portfolio, without adding more Shareholder’s capital. Technically, under the Loans to Deposit Ratio (L/D Ratio), the Bank can hold a bigger financing portfolio the higher the Core Deposit amount.

This is the desirable outcome. To collect higher “Core Deposits” via Savings Account, Current Account and General Investment Account (Term Deposits).

With the new IFSA, the Core Deposit definition is redefined.

- If the return of the customers deposit (capital) can be guaranteed, this capital is classified as Deposits.

- If the return of the customers deposit (capital) cannot be guaranteed, this capital is classified as Investments.

With this, the industry is turned on its head.

Obviously, a Mudaraba, or Wakala fi Istihmar (Agency for the purpose of Investment) will be classified as “non-Core Deposits”. The nature of Mudaraba is investment, and no matter what mechanism one puts into the product to “protect capital”, one cannot GUARANTEE capital due to the potential of loss. This risk sharing is one of the key tenets of a Mudaraba arrangement. By keeping to this tenet, Mudaraba should be classified in its rightful place i.e. Investment.

As mentioned, removing the deposits as reclassifying it into Investment has significant impact on the L/D Ratios.

But also, what’s worrying is that to keep Mudarabah (or Wakala), now defined as Investments, there is a separate Investment Account Guidelines which the Banks will have to comply with. Now that’s another story.

As an industry, we are faced with an option of either:

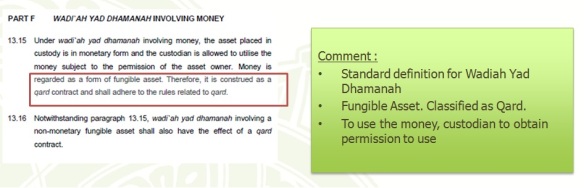

- Building our Core Deposits via an alternative product which Guarantees the capital. We have the readily available Wadiah structure, which is similar to a Qard deposit structure where no benefits can be offered or promised to the customer for their deposits; or

- Comply with the Investment Account Guidelines to keep with Mudaraba or Wakala Investment, but will not be able to include those amount into the Core Deposit calculations; or

- Develop new deposit structures that will meet both the Deposit definitions and meet customer demands for returns on their deposits and savings. Unfortunately, the available structures in the market requires extensive capital and technological enhancement, while operationally not viable. The industry as a whole has so far not come up with any viable proposition. Research has been done but the disadvantages of such structures outweigh the benefits.

This re-classification, may on the onset, looks a simple thing. But the impact is huge. The risk of capital flight is significant, possibly flight into conventional banking if the consumers are not able to accept the risks of investments or the returns uncertainty of deposits. It will be interesting to see what the industry comes up with.

I remember following BNM briefing on the re-classification back in 2011, the boss has asked me to come up with a Term Deposit under the contract of Wadiah. He knows it is not feasible, but still he asked for it. It only reflects how desperate the time will become when the full significance of the Act is enforced on us.

Now that it is enforced, I wondered if the rope around my neck is long enough.