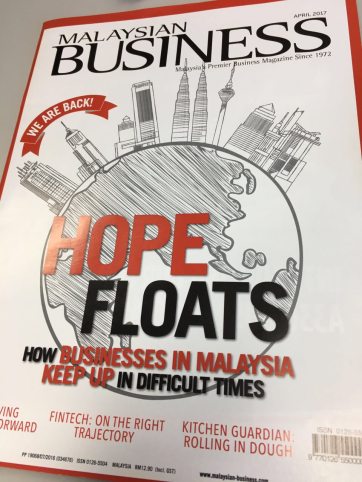

We Are Back!

That was the rebirth issue of the Malaysian Business in April 2017.

This magazine was one of my main reading requirements when I was still a relationship manager for Business Banking and Commercial Banking way back in the early 2000’s. It gave me some insights for my daily conversation with customers. Nowadays I hardly read an actual magazine; all been replaced by this thing called Mobile Phone. So it was a surprise to see this magazine making a comeback.

This magazine was one of my main reading requirements when I was still a relationship manager for Business Banking and Commercial Banking way back in the early 2000’s. It gave me some insights for my daily conversation with customers. Nowadays I hardly read an actual magazine; all been replaced by this thing called Mobile Phone. So it was a surprise to see this magazine making a comeback.

Acquired by the Amanie group owned by Datuk Dr Daud Bakar, I was expecting the contents to be Islamic Banking-heavy. But I think in keeping with the original spirit of its readership, it is Malaysian Business as usual (no pun intended!). There are some contents on Islamic Banking and Services, and I guess the editors are taking it one subject at a time.

So I spoke to my trusted counterpart, Ahmad Faizal (pic), to ask his opinion on the magazine and his thoughts on the comeback. The common magazines come to mind; Personal Money and TheEdge. Simply because of the established contents and great stories that grab attention. Malaysian Business needs to benchmark itself to these magazines. Especially during times that there is insufficient readerships of physical magazines. Faizal also observed that there is no emphasis on Islamic Banking, which may well be a differentiation factor. Faizal also have fond memories for Islamic Banker magazine edited by Mushtak Parker. Many new information covered in the magazine for example the latest structure of deals etc. and hoping that Malaysian Business adopt certain areas based on this magazine.

So I spoke to my trusted counterpart, Ahmad Faizal (pic), to ask his opinion on the magazine and his thoughts on the comeback. The common magazines come to mind; Personal Money and TheEdge. Simply because of the established contents and great stories that grab attention. Malaysian Business needs to benchmark itself to these magazines. Especially during times that there is insufficient readerships of physical magazines. Faizal also observed that there is no emphasis on Islamic Banking, which may well be a differentiation factor. Faizal also have fond memories for Islamic Banker magazine edited by Mushtak Parker. Many new information covered in the magazine for example the latest structure of deals etc. and hoping that Malaysian Business adopt certain areas based on this magazine.

Early days yet. I love the rebirth, and hope to have more. Heard the May issue is out. Gotta get it. Click on the picture below to go to www.malaysian-business.com & happy reading!

[Excerpt from Datuk Dr Daud Bakar FB page]

Revival of Malaysian Business Magazine – Amanie Media – New Editor in Chief

I am happy to share with you that we have launched Malaysia’s Premier Business Magazine in April 2017.

I am happy to share with you that we have launched Malaysia’s Premier Business Magazine in April 2017.

First published in 1972, the magazine, now to be published by new owner Amanie Media Sdn Bhd with founder and renowned Global Entrepreneur and Shariah scholar Datuk Dr Mohd Daud Bakar as the Editor in Chief, is set to hit the news-stands in April 2017.

With the theme of Hope for The Malaysian Nation, Malaysian Business is on a mission to be at the forefront of motivational and inspiring business establishments’ stories. From financial advice for start-up companies to success stories from millionaire business founders, Malaysian Business aims to help readers at enlivening their passion and business goals in life.

The magazine spans on a range of business topics, technology insights, business culture, personal financing tips as well as stories of successful entrepreneurs who share secrets of their success from the ground up.

Sections in the magazine will include:

- Trending Facts and News – Highlights of International and Local News

- Corporate and Market Capital Roundup – review on latest market updates

- MB Preneur – Stories from the Unsung Heroes of SME’s

- Walking down Memory Lane – Stories on how we can recreate success histories

- Reader’s Page – Pour your thoughts out, we want to hear from you!

- After Biz – an insight into the latest gadgets, automotive and trends

Come and join our network of trade leaders and key players by subscribing to Malaysian Business!

Islamic Finance has seen many criticisms for the past decades, ranging from whether the right model was introduced in the first place, to questions on the mirroring of conventional products into islamic alternatives, accusations of Hilah and back-door riba, suitability of certain contracts in the banking space, and even the end accomplishment of the Maqasid of Sharia via a financial intermediary model.

Islamic Finance has seen many criticisms for the past decades, ranging from whether the right model was introduced in the first place, to questions on the mirroring of conventional products into islamic alternatives, accusations of Hilah and back-door riba, suitability of certain contracts in the banking space, and even the end accomplishment of the Maqasid of Sharia via a financial intermediary model.