CAN ISLAMIC FINANCIAL INSTITUTIONS DO IT ALL? MUST ISLAMIC FINANCIAL INSTITUTIONS DO IT ALL?

For the longest time, Bank Negara Malaysia (BNM) have been conducting their experiments on Islamic Banking institution to build a viable business model that can be the example to the world. Islamic Banks are naturally seen as the prudent, stable and right platform to design, build and test new structures and conditions. That exploratory mode has resulted in an industry that is not just adaptive and innovative, but also strongly built around Shariah.

EXPECTING THE MULTI-TALENTED BANKS TO DELIVER ALL THE FUTURE ENDEAVOURS.

Yet, it has not always been smooth sailing. Although there is stability in financial institutions, adding new roles and functions to the institution can sometimes result in instability, uncertainty and financial pressure. When a bank has been operating successfully for many years under a certain operating model, a new requirement will certainly result in material changes; some of which may be disruptive.

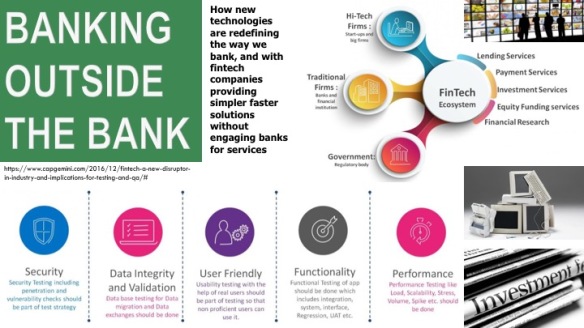

Due to the changing nature of the financial markets and the entrance of new disruptors to the industry, financial institutions including Islamic ones, are asked to innovate, adopt and adapt to remain competitive in the “new” industry.

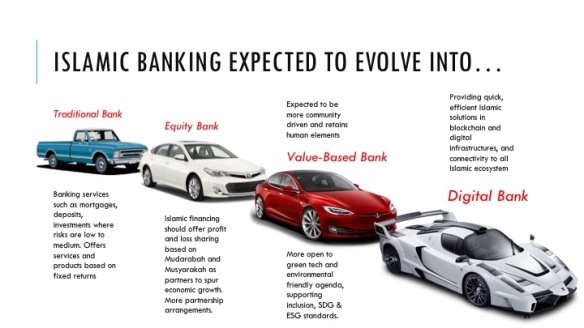

Perhaps it is worth to list down the roles that Banks are asked to play over a foreseeable period of time, either evolving into or playing multiple roles at the same time:

- TRADITIONAL BANK : Based on the old and tested conventional banking model, we are generally a traditional bank, which is a blue sturdy truck. The Bank’s commitment is to provide sales and services easily useable by each customer and the products on offer are what is very much familiar to consumers in the market. Common, generic, with some sophistication to cater for different individuals, but mostly safe products. The level of risks that is to be willingly undertaken by a traditional bank’s shareholders (capital providers) are generally low risk to medium risk. Products generally offered are Debt-Based or Sale-Based, with little risk appetite for high risk products. Risks are mitigated by pricing of products i.e. the higher the risks associated with a product, the higher the pricing will have to be (Risk Informed Pricing). Most of the Islamic Banks in the market start of this way, and still prefer this model, simply because the bank is SET-UP based on THIS model since inception. All the bank’s infrastructure is set-up to manage the operations of a traditional bank.

- EQUITY BANK : Traditional Islamic Banks are the “expected” to move into the “equity investment and financing” model, simply by virtue of the notion that equity or investment intermediation is more “Islamic” than debt-based financial intermediation. While scholars are encouraged by the efforts to introduce contracts such as Ijarah, Musyarakah Mutanaqisah or Istisna’a for financing, and Mudarabah and Wakalah bi Isthihmar for investments, this does not mean that the banks are moving into “equity” structures. Far from it, as the banks, which remains traditional in nature, retains the same level of risk appetite and infrastructure. Really, what has changed from the traditional model into the intended equity model? The risks appetite from the shareholders remains low to medium, and thus not logical to undertake high risk investment and equity financing products. We are not set up like that! If you assess the contracts under the so-called equity structures, many times there are undertaking clauses (Wa’d) that allows for a debt-based recourse should things go wrong or into default. It is arguable that having some equity-based structure qualifies the bank to transform from a traditional bank to an equity bank.

- VALUE-BASED BANK : What is a value-based bank? Ever since the introduction of the strategy paper of Value Based Intermediation (VBI) by BNM to re-align some of the concepts with widely-accepted global standards of ESG’s and SDG’s, the Islamic Banks have been wondering what is the best approach to move into this space. There is a fine line between CSR activities, ESG adoption in practices, and VBI which aims to be an all-encompassing standard for Islamic Banks based on the Maqasid Shariah (objectives of Shariah). Not many Islamic banks have a clear understanding of the requirements, as they are asked to service and support a narrower group of customers operating in sustainable, green, environmental friendly business, that has a positive social impact to the community, while retaining a good level of profitability. It is a small group of customers in Malaysia that is aware of the benefits of operating a “value-based” business. There is no direct incentive from financial institutions for going green. Again, the set-up of a traditional bank is to maximise returns at the lowest possible acceptable risks. Financing into industries which are green and sustainable and new tech and unconventional and requires new understanding of business model is NOT AN EASY SWITCH in thinking and credit decisioning for any traditional banks. Thus so far, Islamic Banks are only focusing on communal activities instead of financing and investment activities into the community (which is a new segment for many banks). Again, the infrastructure is not necessarily set up to handle VBI.

- DIGITAL BANK : This is really a stretch to expect Islamic Banks to also look at structures involving blockchains, smart contracts, eWallets, cryptocurrencies, P2P and crowdfunding platforms. There have been many forums and seminars on these topics of Disruptions in Banking as well as Islamic Banking. There is no model to refer to at the moment. The banks are out of their element when it comes to fintech. There is uncertainty in the types products that can be offered. There are no guidelines or regulations from BNM yet. While the Digital Revolution 4.0 envisioned banks becoming a new value proposition breaking away from traditional products, the set up is again the main deterrent factor where banks are not designed for the virtual world. The Digital Bank will be more attractive to a different set of customers who are different from the Traditional Bank’s customers. It is however, trendy to be “Digital” but whatever digital transformation that we see happening today are mostly “digitalisation of existing banking products and processes” to improve efficiency and turn paperless. Converting a manual process into an automated process is hardly becoming digital. All the products and processes are still very traditional. The proper term is Automation or Digitalisation. That’s it.

WHY MUST IT BE A SINGLE ENTITY TO DO EVERYTHING?

I feel it is unfair to expect everything from the Bank. For many years Islamic Financial Institutions were asked questions such as “Why don’t Islamic Banks do more Musyarakah products or Mudarabah products?” and “We should share the risks between the customer and bank” and “Why not you help the community to give more charity?” or even “Banks shouldn’t charge profits so high but instead give interest-free loans to customers” statements.

My answer is this: Why must Banks? We are set up based on a certain criteria, with restrictions in our capital, governed by the financial ratios similar to conventional banks, able to handle only a certain type of risks, and serves a particular market segment. The idea of banks is very much different from what we envisioned Islamic Banks to be able to do. It is like a wooden box where you keep adding new stuff. It won’t expand. The new stuff WILL NOT FIT.

THIS CONCEPT OF HAVING AN ECOSYSTEM

In my last posting, I mentioned about Islamic Banking ecosystem, where different entities set up for different purposes should live separate but with connected lives. A Bank is set up to handle financing based on low-risk debt at the lowest cost of capital; leave them be. It will be unreasonable to ask them to take higher risks products while their capital is provided by low-risk investors and shareholders. There will be reluctance to engage in higher risks without higher returns.

So each institutional variation should be part of the larger financial ecosystem where each institutions have a specific role to play. Then the capabilities of each institution will be enhanced based on their function. It is true that some of the function can overlap into multiple models, but more of complimentary offering but not primary.

My suggestion: Stop asking one entity to do what they are not set-up to do in the first place.

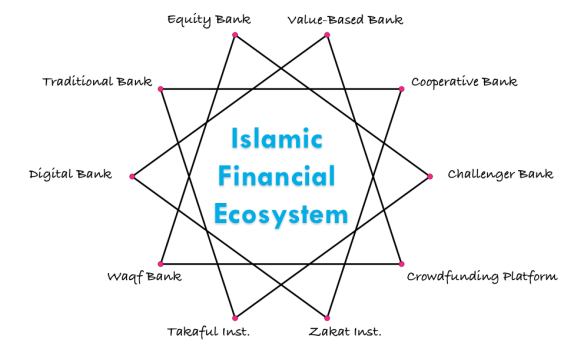

I like this idea of an ecosystem where one party interacts and lives off other parties, at the same time contributes to other parties. If I may propose the components of the ecosystem:

- Traditional Bank : Debt-Based products, SImple Products, Low Risk/Low Returns, Fixed Returns or Floating Returns, Financially Stable with observance of regulatory ratios, Service Provider, Asset Management. Highly Regulated. Product Replication and Financial Supermarket.

- Equity Bank : Equity-Based products, Sharing arrangeent, Medium to High Risks, Potentially above average returns, Requires strong capital and liquidity, Sustainable business strategy needed, Investment Management, Highly Regulated, Product Differentiation compared to conventional bank offers.

- Value Based Bank : Combination of Debt-based and Equity-based products. Product embedded with value elements (CSR, charity, financial inclusions, community outreach), requires strong flow of income, sustainable strategy required, micro-financing and bespoke financing, Cash Flow Management, Shariah-centric, Ethical Banking values, Product partnerships.

- Cooperative Bank : Shareholders value, investment driven, community based. High RIsks / High returns, serving unbankable and micro financing and consumer needs. Sustainable income flow. Self sufficient and self generating income. Local impact. Operates outside the capital markets. Highly Regulated but different regulations. Consumer-based products. Profit and loss sharing.

- Digital Bank : Outside the traditional banking environment. Core system based on blockchain infrastructure. Alternative currencies such as Ethereum and Bitcoin. Services driven, but allows for financing via crowdfunding or P2P and alternative sources. Digital contracts, smart contracts and robo-advisers. Linked into Big Data and digital Apps. Fintech based. Speed, Accuracy, Security, Reliability and continuous building of technology.

- Challenger Bank: Serving the underbanked, unbanked and minority communities. High returns due to the higher risks, but potentially more lenient credit requirements. Requires high capital, and high liquidity to service the segment. Can be fintech based and offers traditional products. Serving the medium-high risks customers that is rejected by traditional banks. Less collateralised requirements.

- Waqf Bank : Deploying unutilised assets and converting it into economic assets that generate returns. Potentially profit sharing arrangement as preferred method. Cheap source to generate economic activities. May be hampered by country’s regulations and mismanagement of the Waqf operator, but medium risk of default. Under-developed structure with high cash-release potential.

- Takaful Institutions : A key component in an Islamic ecosystem. Provide mutual protection for member contributors and having large cash reserves for investment and funding deployment. Long term sustainability business, and strong understanding of risk and its correlation to returns. Potential liquidity provider.

- Zakat Institutions : An important wealth aggregator and distributor. Set up to cater for very specific segment of the market aimed at improving the economic condition of the segment. Potential source of funding for the economy.

- Fintech and Crowdfunding : An alternative digital solution aimed at providing greater access to liquidity and funds at the fastest and most efficient manner. Higher risks but will serve a certain segment, similar to venture capitalist structures. Potential Disruptor.

BUILD THE ISLAMIC BANKING ECOSYSTEM

Since no one is telling, let me suggest what do we need to have a working Islamic Banking Ecosystem.

- Interbank Market – While liquidity is available in the real world, a mechanism should be designed to flow money from the interbank physical into the blockchain digital.

- Financial Institutions Model – There could be various financial institution models but each must have clear objectives and reason for being. Be specific and focus in building capabilities. Overlap can occur but generally each institution must focus in a single purpose.

- Fintech – Fintech must be the bridge between the real world and the blockchain digital world. Apps must be able to transfer money seamlessly and link to relevant records. All fintech development should focus on linking the two worlds.

- Interconnectivity – All elements in the blockchain and all financial institutions must be linked to facilitate transactions between both staging areas.

- Alternative Structures – There are still many underdeveloped structures that lives in a very small space. It is not greatly promoted or known thus letting it gather dust. Some great ideas may have been overlooked or demised but the industry must relook and ask how much does such structures contribute to the overall economy.

- Products – Products in both Digital world and Physical world may look and function differently because of the infrastructure they are in, but both Digital and Physical MUST be able to talk to each other despite the difference.

SUMMARY

Stop asking the Islamic Financial Institutions to load on new structures, concept or products that are not suitable for them. Develop infrastructure in separate operating model with the resources available that can fit into the overall ecosystem. Let those models grow side by side with the rest of the financial institutions in the same space. A financial ecosystem needs to be built where all the important components and institutions are linked and working together for a single purpose : to build a sustainable ecosystem for financial institutions.

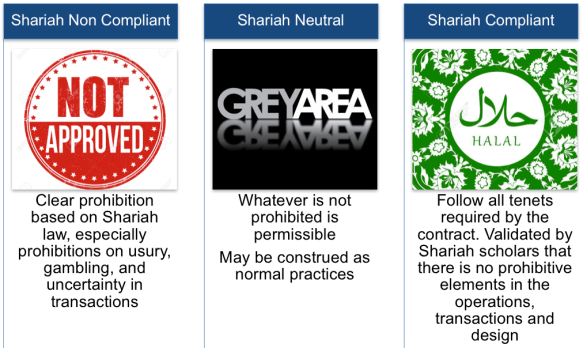

It is an interesting situation in Malaysia now, when it comes to food. In general, Malaysia as a Muslim country, the expectation is that the food consumed must be Halal and more importantly certified as such. The reason for it is that it gives comfort to the public that certain standards are adhered to according to religious requirements. To walk into a restaurant with the Halal signage gives us Muslims confidence to consume the food till our bellies are filled.

It is an interesting situation in Malaysia now, when it comes to food. In general, Malaysia as a Muslim country, the expectation is that the food consumed must be Halal and more importantly certified as such. The reason for it is that it gives comfort to the public that certain standards are adhered to according to religious requirements. To walk into a restaurant with the Halal signage gives us Muslims confidence to consume the food till our bellies are filled.