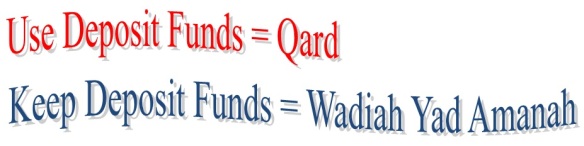

I wrote earlier in July 2014 about re-branding Wadiah following discussions the industry had with BNM. In that meeting, the key take-away was that there is an intention to re-brand Wadiah into Qard, to which the industry reacted negatively as Wadiah has always been used for short-term deposit structures where discretionary hibah “gifts” are given to depositors. BNM contention was that Wadiah do not meet the practice of the Bank where Wadiah was supposed to be taken as “safe-keeping based on trusteeship” (Wadiah Yad Amanah) or “safe-keeping with guarantee” (Wadiah Yad Dhamanah). The main argument was the under the Wadiah structure, the ownership of the fungible asset remains with the customer and the Bank has not obtained sufficient consent from the customer to utilise their funds, specifically for Wadiah Yad Dhamanah.

The solution for the above conundrum, offered by BNM, is therefore, migrate to Qard-based products, where by virtue of it being a loan from the customer to the Bank, the ownership is transferred to the Bank allowing the Bank to utilise it as it pleases, while guaranteeing the loan amount upon demand (you have to repay back the loan).

As mentioned in my earlier writing, some industry players has clear reservation to convert Wadiah to Qard, seeing that the various guidelines are coming thick and fast to comply with requirements under Investment Accounts. Handling another major change in regulations will just hamper the industry’s growth.

Now, 16 January 2015. The revised Concept Paper for Wadiah was issued. We are given 1 month to respond with our feedback.

The biggest shock is that the paper has re-defined Wadiah as only Wadiah Yad Amanah i.e. safe-keeping trusteeship. There was NO mention of the contract that most Banks are currently using for Current Account / Savings Account i.e. Wadiah Yad Dhamanah (safe-keeping with guarantee) which allowed the Banks to utilise the funds for Bank’s activities. What this removal of definition means:

- The Bank takes Customer Assets and safely keeps as Wadiah in the Bank until a request to withdraw the Asset is made by the customer. The Bank must return the initial Asset to the customer upon request, with no obligation to provide any other benefits.

- The Bank does not have the right to utilise this Asset under Wadiah anymore #.

- If the Bank intents to utilise the money for purpose of generating returns, then the rules of Qard must apply i.e. for the Bank to obtain the right to utilise the money, the ownership of the money must be transferred to the Bank i.e. the customer no longer has financial and ownership rights when the funds are utilised by the Bank to generate returns. It is a loan by the customer to the Bank. As owner of the money now, the Bank has full rights to the returns. The Bank has no obligations to the customer except of return of the loan on demand. Discretionary hibah “gift” may be given, but questions may soon come on its validity when it is deemed as “Urf” (customary, no longer discretionary).

# Previously under the rules of Wadiah Yad Dhamanah, if the Bank intends to utilise fungible Assets deposited by customers to Banks such as money, sufficient consent must be obtained before the Bank utilise the money for other purpose (including for generating returns). In reality, this consent is really lacking especially for a daily product such as Current Account or Savings Account, resulting in insufficient rights to use customer’s fund to generate returns. The Banks are also not allowed to agree the returns up-front for the use of the money yet circumvents this by publishing historical rates of returns instead. This “historical return” soon was construed as non-discretionary and deemed as returns that is treated as Urf’. Therefore, Wadiah Yad Dhamanah was totally removed by BNM as a viable Islamic Banking concept, and now to be replaced by Qard (where ownership of funds are wholly transferred to the Bank).

In any circumstances, Banks do utilise the Customers’ money for banking activities, including investments. If we retain Wadiah under this new BNM definition, then it will greatly impair Islamic Banks if we are not able to utilise collected funds for generating profit. The Wadiah moving forward will only apply for Safe Deposit Box services where the Bank can charge a minimal fee for safe-keeping services. Trying to apply it to anything else will be a challenge.

The Qard guidelines needs to come sooner than later. At least the Exposure Draft or the Concept Paper needs to be available for discussion and for Banks to assess the Impact going forward. The impact by IFSA 2013 will be fully felt right after the coming months of June 2015, and this new regulation will further add to the re-branding of Islamic Banking currently taking place in Malaysia.