Under IFSA 2013, it is no longer about Product Innovation. It is about Product Compliance.

2 weeks ago I had a session with some bright individuals discussing the Islamic contracts commonly used in Corporate Banking financing structures. We went through almost all the available Islamic financing contracts such as Murabaha, Ijara, Musyaraka and Mudharaba, where I highlighted that all these contracts now have their own Policy Document issued by Bank Negara Malaysia (BNM). The Policy Documents, in my opinion, are a concise version of a lot of Sharia regulations and great reading source. It becomes a reference point where management roles and responsibilities are outlined, operational behaviour laid down, and theoretical basis is justified and explained.

It is a matter of time, I told the participants, that these Policy Documents are taken in their full context and finally developed into a comprehensive structure with clear compliance to Sharia requirements. We, as Islamic Bankers, are in for an exciting period of development where we will have a chance to develop “real” Islamic banking contracts.

The moment I said that, I realised it is NOT TRUE!!!

THE IMPACT OF IFSA 2013

The popular belief is that IFSA 2013 is meant to realign all the Islamic Banking regulations in the Islamic Banking Act, Takaful Act and various major guidelines into a single overarching Act. IFSA 2013 consolidates the various practices into more clarity and re-classification of concepts. However, the perception that Islamic Banking in Malaysia as an innovative development hub would no longer hold true. “Innovation” was the key thinking and pride-point prior to IFSA 2013; now I believe the right word is “Compliance”.

When we first started the Islamic Banking journey in late 1990’s and early 2000s, BNM encouraged a lot of product innovation from Banks as there were no existing guidelines. We looked at the various structures that provides the desired outcomes and discussed with Shariah Committee on the design and component of products without breaching Sharia rules. BNM was supportive on us developing these “innovative” products. Some may have been controversial (such as Bai Inah, Bay Ad Dayn, Wadiah and Bai Bithaman Ajil) but it encourages discussions alongside the mantra that “whatever is not explicitly prohibited, is permissible“. Sometimes we were forced to think outside of the box, especially for sophisticated products mirroring conventional. We also received support from Sharia Committees whom temporarily approved “innovative” products with the understanding that over time, a better solution were developed as replacements.

When we first started the Islamic Banking journey in late 1990’s and early 2000s, BNM encouraged a lot of product innovation from Banks as there were no existing guidelines. We looked at the various structures that provides the desired outcomes and discussed with Shariah Committee on the design and component of products without breaching Sharia rules. BNM was supportive on us developing these “innovative” products. Some may have been controversial (such as Bai Inah, Bay Ad Dayn, Wadiah and Bai Bithaman Ajil) but it encourages discussions alongside the mantra that “whatever is not explicitly prohibited, is permissible“. Sometimes we were forced to think outside of the box, especially for sophisticated products mirroring conventional. We also received support from Sharia Committees whom temporarily approved “innovative” products with the understanding that over time, a better solution were developed as replacements.

Now with the issuance of the Policy Documents, such innovation becomes limited. Innovation is now ring-fenced around compliance to Shariah rules (either from regulators or internal Shariah Committee), and the Banks are expected to follow these rules to the letter. Breaches to these rules becomes the responsibility of the Bank’s Shariah Committee and detailed deliberation is greatly expected to provide the solution. Compliance first; if it is not covered in the documents, it probably cannot be done without a lot of effort.

CHOOSING THE SIMPLEST ALTERNATIVE

With compliance now being the vogue vocabulary with BNM, Banks had to look hard to the Policy Documents to ensure the requirements are identified and gaps filled for fear of breaches or fines. The gap analysis falls into the line whether “are we complying to the requirements?” and not “how do we do this without it becoming a gap or compliance issue?”. Both Shariah and Bank’s Product teams would now look on how to comply with Policy Documents instead of using the Policy Documents as a reference to develop a product.

What I noticed since 2014 is the obsession to comply with Islamic contract requirements, and if the team feels it is difficult to comply, the next logical step is to avoid such contract altogether and seek an alternative contract which is easier to comply with. For example, the Murabaha Policy Document issued in 2014. I have to say it is a beautiful document, and outlines the requirements for Murabaha Purchase Orderer (MPO) that reflects the full Sharia requirements of ownership transfers, risk taking, profit and management of actual assets.

These requirements, which in the eyes of many Banks, may be difficult to fully comply with due to many reasons: shortage of expertise, systems infrastructures limitation, people understanding, complicated processes, operational risks, credit issues and fund management requirements. Instead of the risk of breaching the Policy Documents, Banks opt for something less “complicated” which offers “similar” structure. The default solution is Tawarruq Arrangement i.e. Commodity Murabaha.

Or, the teams looks at Ijara Policy Document. It outlines further the roles and responsibilities of lessor and lessee, while the asset remained in the Bank’s ownership throughout the lease tenure. Again, if a roadblock occurs where a Bank cannot fully comply… Tawarruq Arrangement provides a quick solution. With very defined rules outlined in Tawarruq Policy Documents, the Banks are confident that offering Tawarruq will not breach any guidelines.

Tawarruq, therefore becomes the default Islamic contract in the market. When I asked the participants during case-studies to the question “What contracts should be used for this structure?”, the answers are unanimous “Tawarruq”. And they are not wrong.

DISRUPTION IN ISLAMIC CONTRACTS

Making Tawarruq as the “all-problems-solved” structure is having an unfortunate result to the industry. While the issuance of the Policy Documents as a reference was to galvanise the development of various Islamic contracts, the Banks have an easy way out in Tawarruq. Now, the rest of the contracts are in danger of being sidelined in favour of continuous development in Tawarruq.

Making Tawarruq as the “all-problems-solved” structure is having an unfortunate result to the industry. While the issuance of the Policy Documents as a reference was to galvanise the development of various Islamic contracts, the Banks have an easy way out in Tawarruq. Now, the rest of the contracts are in danger of being sidelined in favour of continuous development in Tawarruq.

For example, the Home Financing product which had evolved from BBA in the 1980s to Diminishing Musharaka in the 2000s. When BBA was introduced, practitioners and Sharia teams identified several practical issues that over a period of time needed to be resolved such as ownership transfer, rights to sell, and sale of properties under construction. These issues led to the development of Diminishing Musharaka as an alternative solution.

But with Diminishing Musharaka, there are still operational and legal issues that have yet to be resolved until today. For example, the “right” contract to be used for period of construction, the application of Ijara and the extensive outlining of Wakalah roles and responsibilities. Failure to understand the issues and provide real solutions puts the Bank at risk. There are also legal infrastructures that have yet to be addressed such as land joint-ownership by the Bank (as a partner), and different practices of land offices for the registration of Bank as a partner. These are roadblocks (and credit risks) to the Banks to take the structure further.

THE DOUBLE-EDGE SWORD OF TAWARRUQ

Malaysia is in danger where I foresee that one day the industry itself will became the absolute global expert in Tawarruq and Commodity Murabaha. With Bursa Suq Al Sila as the leading commodity trading platform for the country, backed by the government (as a national bourse), the Tawarruq structure is expected to evolve into an efficient Islamic-structure engine. The processes of Commodity Murabaha will become seamless, and may even integrate into a Bank’s core banking system, the operation for buying and selling commodity will become commonplace and familiar, and this will result in effective processing, awareness of Shariah risks, compliance to trading requirements and well as reduction in overall operational risks.

Malaysia is in danger where I foresee that one day the industry itself will became the absolute global expert in Tawarruq and Commodity Murabaha. With Bursa Suq Al Sila as the leading commodity trading platform for the country, backed by the government (as a national bourse), the Tawarruq structure is expected to evolve into an efficient Islamic-structure engine. The processes of Commodity Murabaha will become seamless, and may even integrate into a Bank’s core banking system, the operation for buying and selling commodity will become commonplace and familiar, and this will result in effective processing, awareness of Shariah risks, compliance to trading requirements and well as reduction in overall operational risks.

Banks will one day become so well versed in Tawarruq, they will question the need for other types of Islamic contract, where they may not able to fully comply with.

With such development, more and more:

- capital investments will be made into perfecting the Tawarruq infrastructure, and Banks will also be able to comply with BNM requirements by investing in human capital familiar with Tawarruq.

- product structures will be developed around Tawarruq and once these products are established, it will be difficult to unwind as a prefered product simply due to the ease of the Tawarruq contract requirements.

- variations and hybrid products will be introduced based on Tawarruq, or containing elements of Tawarruq to solve “difficult scenarios” for compliance.

We will one day have an innovative and world class Tawarruq product, but no development in the other major Islamic contracts. Innovation will stall and Banks will choose quick returns and operational ease of Tawarruq. It is a dilemma of the industry where it is heading to “one” major solution for almost all “sale-based products”.

It is unfortunate if Banks chose to abandon the other contract alternatives, where such contracts will never reach its full operational and theoretical potential.

Hoping that a Bank will take the lead to develop products based on all the various Policy Documents instead of relying on only Tawarruq and its variations. The industry needs expansion and enhancement and by focusing on only Tawarruq, the industry will not be able to explore exciting products and expand its horizon. The Policy Documents, as beautifully written as they are, may tragically one day just becomes an academic relic issued by BNM.

Wallahualam.

Earlier writings on Tawarruq and Commodity Murabahah:

- Reliance on Commodity Murabahah

- Financing : Commodity Murabahah and Tawarruq

Interesting article in LinkedIn

But how about the value chain of chicken rearing? Yes, the minimum requirement is met i.e. halal slaughter, but the end-to-end practices in this single transaction have not been looked at. Will it meet the standard that will be imposed by Shariah if they are made aware of it? Let’s look at the value chain of chicken rearing.

But how about the value chain of chicken rearing? Yes, the minimum requirement is met i.e. halal slaughter, but the end-to-end practices in this single transaction have not been looked at. Will it meet the standard that will be imposed by Shariah if they are made aware of it? Let’s look at the value chain of chicken rearing.

I am happy to share with you that we have launched Malaysia’s Premier Business Magazine in April 2017.

I am happy to share with you that we have launched Malaysia’s Premier Business Magazine in April 2017.

Islamic Finance has seen many criticisms for the past decades, ranging from whether the right model was introduced in the first place, to questions on the mirroring of conventional products into islamic alternatives, accusations of Hilah and back-door riba, suitability of certain contracts in the banking space, and even the end accomplishment of the Maqasid of Sharia via a financial intermediary model.

Islamic Finance has seen many criticisms for the past decades, ranging from whether the right model was introduced in the first place, to questions on the mirroring of conventional products into islamic alternatives, accusations of Hilah and back-door riba, suitability of certain contracts in the banking space, and even the end accomplishment of the Maqasid of Sharia via a financial intermediary model.

When we first started the Islamic Banking journey in late 1990’s and early 2000s, BNM encouraged a lot of product innovation from Banks as there were no existing guidelines. We looked at the various structures that provides the desired outcomes and discussed with Shariah Committee on the design and component of products without breaching Sharia rules. BNM was supportive on us developing these “innovative” products. Some may have been controversial (such as Bai Inah, Bay Ad Dayn, Wadiah and Bai Bithaman Ajil) but it encourages discussions alongside the mantra that “whatever is not explicitly prohibited, is permissible“. Sometimes we were forced to think outside of the box, especially for sophisticated products mirroring conventional. We also received support from Sharia Committees whom temporarily approved “innovative” products with the understanding that over time, a better solution were developed as replacements.

When we first started the Islamic Banking journey in late 1990’s and early 2000s, BNM encouraged a lot of product innovation from Banks as there were no existing guidelines. We looked at the various structures that provides the desired outcomes and discussed with Shariah Committee on the design and component of products without breaching Sharia rules. BNM was supportive on us developing these “innovative” products. Some may have been controversial (such as Bai Inah, Bay Ad Dayn, Wadiah and Bai Bithaman Ajil) but it encourages discussions alongside the mantra that “whatever is not explicitly prohibited, is permissible“. Sometimes we were forced to think outside of the box, especially for sophisticated products mirroring conventional. We also received support from Sharia Committees whom temporarily approved “innovative” products with the understanding that over time, a better solution were developed as replacements. Making Tawarruq as the “all-problems-solved” structure is having an unfortunate result to the industry. While the issuance of the Policy Documents as a reference was to galvanise the development of various Islamic contracts, the Banks have an easy way out in Tawarruq. Now, the rest of the contracts are in danger of being sidelined in favour of continuous development in Tawarruq.

Making Tawarruq as the “all-problems-solved” structure is having an unfortunate result to the industry. While the issuance of the Policy Documents as a reference was to galvanise the development of various Islamic contracts, the Banks have an easy way out in Tawarruq. Now, the rest of the contracts are in danger of being sidelined in favour of continuous development in Tawarruq. Malaysia is in danger where I foresee that one day the industry itself will became the absolute global expert in Tawarruq and Commodity Murabaha. With Bursa Suq Al Sila as the leading commodity trading platform for the country, backed by the government (as a national bourse), the Tawarruq structure is expected to evolve into an efficient Islamic-structure engine. The processes of Commodity Murabaha will become seamless, and may even integrate into a Bank’s core banking system, the operation for buying and selling commodity will become commonplace and familiar, and this will result in effective processing, awareness of Shariah risks, compliance to trading requirements and well as reduction in overall operational risks.

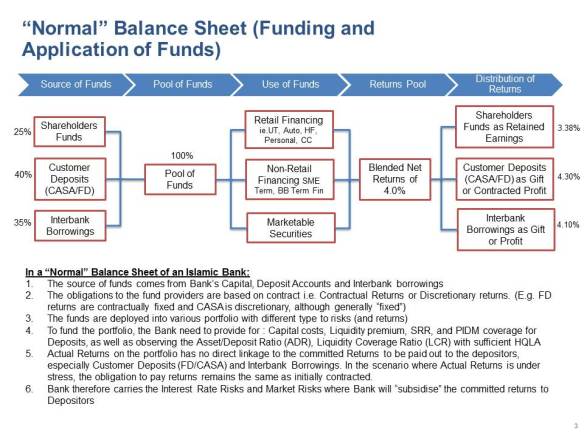

Malaysia is in danger where I foresee that one day the industry itself will became the absolute global expert in Tawarruq and Commodity Murabaha. With Bursa Suq Al Sila as the leading commodity trading platform for the country, backed by the government (as a national bourse), the Tawarruq structure is expected to evolve into an efficient Islamic-structure engine. The processes of Commodity Murabaha will become seamless, and may even integrate into a Bank’s core banking system, the operation for buying and selling commodity will become commonplace and familiar, and this will result in effective processing, awareness of Shariah risks, compliance to trading requirements and well as reduction in overall operational risks. 2016 was another interesting year for Islamic Banking. Economically, the industry followed the growth trend of the market; while still recording about 12.10% growth in the first 6 months of 2016, it is showing a slowdown in line with the overall economy. Nonetheless, there are still significant demand in Islamic Banking, and some financial institutions are also in the midst of moving from a conventional offering into Islamic Banking. Bank Pembangunan, for example, is undergoing transformation exercise into Islamic Banking. And another foreign bank just started to offer Islamic Banking products via a window in July. Small steps towards increasing the market presence for Islamic Banking.

2016 was another interesting year for Islamic Banking. Economically, the industry followed the growth trend of the market; while still recording about 12.10% growth in the first 6 months of 2016, it is showing a slowdown in line with the overall economy. Nonetheless, there are still significant demand in Islamic Banking, and some financial institutions are also in the midst of moving from a conventional offering into Islamic Banking. Bank Pembangunan, for example, is undergoing transformation exercise into Islamic Banking. And another foreign bank just started to offer Islamic Banking products via a window in July. Small steps towards increasing the market presence for Islamic Banking.

It has been quite some time since I last posted here and I do apologise for that. I have recently joined a new organisation at the moment heavily in the midst of launching an Islamic Banking proposition to their customers. Safe to say that the amount of work is monumental but launching an Islamic proposition is always the good fight for me. We expect then “live date” to be sometime July 2016 and hopefully I will have a bit more time thereafter to finally complete the various drafts laying in my box.

It has been quite some time since I last posted here and I do apologise for that. I have recently joined a new organisation at the moment heavily in the midst of launching an Islamic Banking proposition to their customers. Safe to say that the amount of work is monumental but launching an Islamic proposition is always the good fight for me. We expect then “live date” to be sometime July 2016 and hopefully I will have a bit more time thereafter to finally complete the various drafts laying in my box.