By Dr Rosana Gulzar

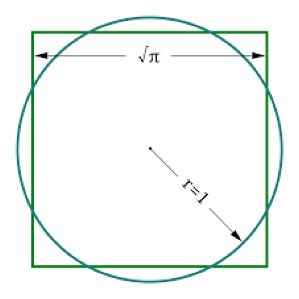

EXCERPT : This is the ‘square’ that the ‘round’ Islamic Banks have been fitted into. So although Islam encourages a range of objectives that include communal welfare and profit-making (Note: NOT profit-maxisiming), Islamic Banks, as Commercial Banks, are almost single-mindedly pursuing the highest profits they can make for shareholders. They do this through all kinds of loans that look eerily like the riba they are supposed to replace. This is the outcome of a decision made by a group of founders in the Gulf Cooperation Council (GCC) countries in the 1970s. They wanted to quickly absorb the people’s newfound wealth from the oil boom. Several earlier attempts at genuine PLS in Egypt failed so the fastest build-up for Islamic banking would be by replicating conventional finance.

EXCERPT : This is the ‘square’ that the ‘round’ Islamic Banks have been fitted into. So although Islam encourages a range of objectives that include communal welfare and profit-making (Note: NOT profit-maxisiming), Islamic Banks, as Commercial Banks, are almost single-mindedly pursuing the highest profits they can make for shareholders. They do this through all kinds of loans that look eerily like the riba they are supposed to replace. This is the outcome of a decision made by a group of founders in the Gulf Cooperation Council (GCC) countries in the 1970s. They wanted to quickly absorb the people’s newfound wealth from the oil boom. Several earlier attempts at genuine PLS in Egypt failed so the fastest build-up for Islamic banking would be by replicating conventional finance.

This is the continuing discussion by Dr Rosana on the above topic, which puts in the case for Cooperative Banks to be a more suitable testbed for Islamic Banking concepts and contracts. Perhaps a new look on what financial structure is most suitable adopt the requirements of Shariah banking is required. What do you think? Do give your comments and contribute to the discussion. Read the full article here or click on the above diagram.

For more writing under Dr Rosana, visit the page in the site which houses more of her writings by clicking below:

As much as I support for PLS contract to be implemented, unfortunately, it has gone thru drawbacks/downfall during KFH time (correct if I’m wrong).

Hard to shy away from debt, even SME customer also hard to get financing because of unsatisfactory of creditworthiness, so the best solution is debt financing.

I wish En Amir can lead the way in promoting PLS in the market.

Just wondering, is it because there is no robust platform/framework/system to support PLS in the market? Totally high risk and big impact on banking industries?

LikeLike

Salam Dr,

I think the main issue with Malaysia is that the market is not familiar with the concept of risk on their capital. The IAP is a pure PLS structure, supported by Banks but the problem is that not many takers. While the market keep saying they want “pure Islamic Banking” and “Profit Sharing Structures”, the minute the industry offers financing structures under Mudarabah and Musyarakah, the market do no want to subscribe to it because afraid of losing capital. Afraid of the risks result in fear of trying and therefore no support. Sometimes we practitioners are frustrated by efforts to offer PLS after spending time to develop the strcutures. No takers by the market, actually.

We cannot expect capital guarantee (like debt financing) but also expecting the most maximum awesome returns. High risk = high returns, low risk = low returns. It cannot be low risk = high returns… it does not work.

The market needs to warm up to the concept of risks as well.

Thanks

Amir

LikeLike