- Contract : Murabahah Contract

- Definition : Cost plus sale

- Transaction : Sale

- Category : Debt

- Secondary contract : Musawamah (simple sale)

- Commonly used for : Asset Financing, Good Purchase, Trade Products.

Murabahah (cost plus profit sale) is one of the most commonly used mode of FINANCING by Islamic financial institutions, especially in the middle-east regions. In countries such as Malaysia however, a different model is more popular i.e. the Bai Bithaman Ajil (BBA), Ijarah or the Musyarakah (and to a certain extend, Musyarakah Mutanaqisah).

Why Murabahah is one more popular form of contract is that the contract is simple to understand and follow and do not require a high degree of sophistication. It is a contract which caters to the simple for of buy and sell, where the straight-through process is easily determinable. It is contract most suitable for any at-arms-length type of transaction, where transparency is the main component.

In Malaysia, for example, the Murabahah is used more for short term financing (less than 1 year pay-off period) rather than long term financing such a Home Financing, which uses the BBA contract.

Definition of Murabahah

Murabahah is a particular kind of sale where the SELLER expressly mentions the incurred COST of the sold commodity, ADD a profit to the cost of the commodity and declares the PROFIT he has earned on the commodity to the BUYER. Thus, the Murabahah is not a loan given on interest, but it is SALE of a commodity for CASH or DEFERRED price. Murabahah involves the purchase of a commodity by the Bank, on behalf of the customer, which is to be sold to customer on a cost-plus-profit basis. Under this arrangement, the Bank DISCLOSES its cost and profit margin to the customer.

MURABAHAH CONTRACT : Each of the following items must be disclosed

COST PRICE OF GOODS (spot) + THE SELLER PROFITS (value added) = SALE PRICE OF GOODS (deferred payment)

In other words, the Bank will buy the desired goods from a third party (or supplier) and sell those goods onto the customer for a pre-agreed price, which is inclusive of the profit the Bank will earn from the customer for the transaction. The profit must be real in terms of substance i.e. the transfer from the supplier and customer must provide a value to the whole transaction.

The verbatim Murabaha definition in the Accounting, Auditing and Governance Standards For Islamic Financial Institutions is as follows:

A Murabaha is defined by Fuqaha (jurists) as sale of goods at cost plus an agreed profit mark up. Its characteristic is that “the seller should inform the purchaser of the price at which he purchased the product and stipulate an amount of profit in addition to this”. (AAOIFI 2008)

Basic Rules of Murabahah

- In Existence. The subject of sale must exist at the time of the sale. Anything that does not exist at the time of the sale cannot be sold and its non-existence makes the contrract void.

- Ownership. The subject of sale must be in the ownership of the seller of the time of the sale. If he sells something that is not FULLY owned by him, the sale of the goods becomes void.

- In Possession. The subject of sale must be in physical or constructive possession of the seller when he sells it to another person. Constructive possession means the seller has not taken physical delivery of the goods, but he has control of its rights and liabilities of the goods including the risks (such as risk of destruction or loss) .

- Same “Majlis”. The sale must be instant and absolute. The sale of goods at a future date or event is void. For example, a Murabahah contract cannot be concluded if the the customer, on 1st January, agrees to sell the goods on 1st February if the goods are already available. A transaction involving the conclusion of a sale at a future date can only be transacted under a different contract i.e. the Salam or Istisna contract, which has a list of its specific terms and conditions.

- Value. The subject of sale must be valuable. The goods must have an explicit material value, which can be determined by the market. Goods without real value cannot be bought or sold.

- Use of Asset. The subject of sale should not be a thing used for un-Islamic purpose.

- Identifiable. The subject of sale must be specifically made known and identified to the buyer. If the goods are not specified and agreed to up-front, the sale is void as the goods may not be the agreed goods at the point of sale. There is a possibility for abuse and conflict should the goods not agreed upon.

- Delivery. The delivery of the subject of sale must be certain i.e. not depending on a contingency or chance. The possibility of delivering the goods is to be assured.

- Price. The price of the subject of sale must be certain and becomes a necessary condition to the validity of the sale contract. If the price is uncertain, the sale is void.

- Unconditional. The sale must be unconditional. A conditional sale is invalid unless the condition is recognised by both parties as an integral / unavoidable part of the transaction according to the usage of the trade.

(Source : Meezan Bank’s Guide to Islamic Banking)

As a summary, a Murabaha is valid if the following conditions are fully met i.e.

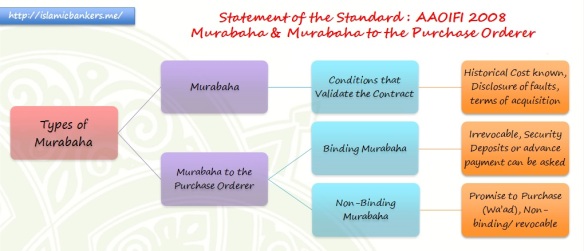

- The Bank should make the cost or capital outlay known to the customer. The cost or capital outlay must be the historical cost of acquisition.

- The Bank should disclose fully any fault on the asset, and any related impact, that occurs after the purchase. This is to decide whether the historical value will remain or materially changed due to the fault after purchase.

- The Bank should disclose also the terms on which the acquisition is made, whether there is any impact on ownership, rights and pricing. For example, if the purchase was made on credit and the credit is outstanding, the ownership by the Bank is therefore not absolute unless the credit obligations are settled; in such instances, the buyer may decide to pay off the acquisiton amount directly to the original seller to remove any obligations or claims on the asset.

If any of the above 3 conditions are not fully met, the customer (purchaser) must be given the option to:

- proceed with the sale as it is

- have recourse to the seller for such discrepency

- cancel the contract

Above is how a Murabaha payment schedule will look like. It looks like exactly how a conventional financing will look and behave, therefore there is no argument that a Murabaha contract is more expensive than a conventional loan (it is not!), and that an Islamic contract is unfair. In comparison, it is at par at face value, and perhaps when you dig deeper into other features of an Islamic financing, it may even turn out to be more beneficial than what you normally see in a conventional loan.

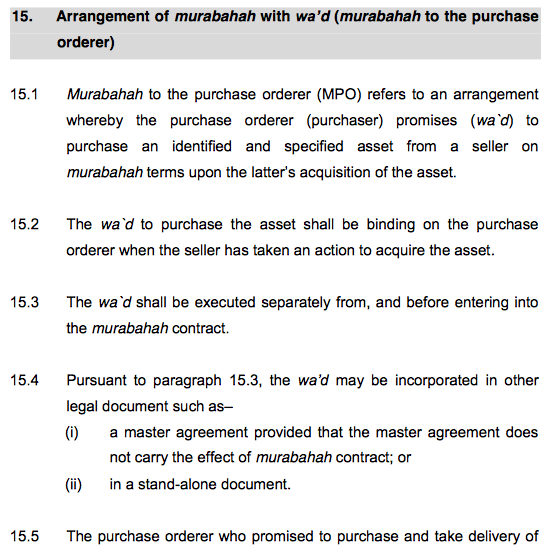

Murabaha to the Purchase Orderer

AAOIFI goes on a step further to actually make a distinctions in the definitions of Murabaha i.e. Murabaha in the general sense, and Murabaha to the Purchase Orderer.

In normal day to day circumstances such as goods trading, a customer may go up to a seller or retailer to purchase existing, ready goods for a sale price. If the transaction to be done is based on Murabaha, the transaction is immediate (same majlis) and the seller must disclose its cost of acquisition and the profit on the sale.

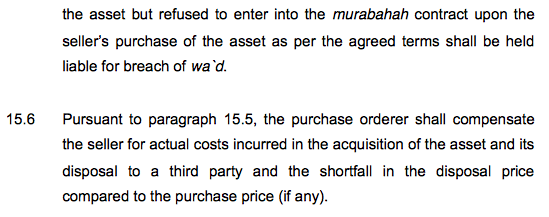

However, if the asset is not in possession at the moment the Murabaha contract is being entered into, the Murabaha is deemed as Murabaha to the Purchase Orderer. This means the asset will only be acquired after all the terms of the Murabaha is agreed and delivery of the asset is done at a later stage. The Murabaha may also be agreed based on the terms of either as a binding Murabaha or Non-Binding Murabaha. The conclusion of the sale will only happen on the date the orderer takes delivery of the asset.

- Under a binding Murabaha, the parties agree that the Murabaha cannot be revoked if the asset is delivered to the orderer. The purchaser of the asset may even request Hamish Jiddiyah (Security Deposit) or Urbun (Advance Payment) from the orderer. A Purchase Undertaking agreement will usually be signed as well.

- Under a non-binding Murabaha, only a promise (Wa’ad) is given by the orderer to the purchaser. The orderer has the option to proceed or cancel the arrangement on the date of delivery, even though the asset is already available. Usually, a non-binding Murabaha is practised for the purchase of assets that is easily disposable, or something transaction for the purpose of creating debt, such as a Commodity Murabaha transaction. Usually there is no Security Deposit, Advance Payment or Purchase Undertaking taken by the purchaser for such arrangement.

The MPO is also adequately addressed in BNM’s Policy documents issued in 2013. The idea of MPO is to take the structure into the realm of “equity financing”, where the Bank, upon purchase of the goods, will hold the goods for a certain period of time. This means the bank will carry the Valuation Risks, Equity Risks and Market Risks, as long as the goods have not been sold and taken by the buyer constructively or physically.

This represents a real risk to the Bank, especially in scenarios where upon purchase of the goods by the bank and holding it for a period of time, the buyer decides not to proceed with the Murabahah. The Bank will then be saddled with goods that is un-disposed in its books. If conditions are right, the Bank may sell the goods into the market at a profit. But where the market conditions are adverse, the Bank may only be able to dispose it in the market at a loss. The Bank cannot go after the Buyer under the contract of Murabahah, as no Murabahah has taken place (since the Buyer declined to proceed). The Bank, therefore holds all the ownership risks, and this is Equity-based structure where the Bank’s equity is not in jeopardy.

BNM’s PD allows the use of “Purchase Undertaking”.

The Purchase Undertaking basically do this : provides an avenue where the Bank ensures that there is a “Risk Transfer” mechanism when certain events happen. The MPO initially starts off as an “Equity Based Structure” where there is risk to Capital while the goods are held by the Bank (Risk Sharing). However during event of default (for example), the Bank will have the option to conver the Equity-Based obligations into a Debt-Based obligation by the customer with the help of Letter of Undertaking (contractual Wa’d). By executing this document, the Customer agrees to undertake the whole obligation of the good (and this removes the risks from the Bank), and agree to pay the outstanding amount immediately (or agree to restructure the amount into something else). This allocation can be read in the Policy Documents as such:

thanks a lot

LikeLike

Under Murabaha contract can we use declining amortization, if not then what are the issues in Murabaha financing. Do share the excel models.

LikeLike

Salam,

The Murabaha contract can use both the declining balance and the rule of 78 method of profit calculation, as long as these methods are clearly communicated to the customers for their understanding and agreement before they sign the documents for the facility. The excel models follows closely the calculation for any conventional loan product. The difference is that there is a selling price, purchase price and total profit earned on the facility in Islamic Banking, which makes it more transparent. The calculation for Islamic Banking products is therefore produced on a schedule of payments which outlines the profit and principal portions in the instalments, and this cannot be changed further after the customer has agreed to the amount in the schedule.

Thanks and Wasalam

LikeLike

Pingback: Interconditionality in Bai-Inah | Islamic Bankers : Resource Centre

Pingback: Musharakah Financing | Islamic Bankers : Resource Centre

Appreciate you blogging tthis

LikeLike

Thank you.

LikeLike