- Contract : Mudarabah Contract

- Definition : Profit and Loss Sharing

- Transaction : Entrepreneurial venture

- Category : Investment

- Secondary contract : Nil

- Commonly used for : Fixed Deposit, Current Account, Savings Account, Interbank Transactions

Mudaraba was a favourite contract amongst Islamic Bankers. It allowed for the notion of investments and profit sharing, while employing investment strategies that mitigates the risk to investments. It is being used for various types of deposit contracts; savings account, current account, term deposits and investment account.

In Malaysia, Mudaraba-based products are classified as Investment Accounts (not Deposits) i.e. non-capital protected, returns based on profit and potentially loss-sharing. This is based on the Investment Account guidelines issued by BNM in 2014.

WHAT IS MUDARABAH?

The contract of Mudaraba is a profit sharing joint-venture where the Investor (as Rab Ul Mal) offers to provide funds to the manager/Bank (as Mudharib) to manage the funds (Ras Ul Mal) in Shari’a compliant investments over a specific length of time.

All the funds for investment are collected in a pool of funds which will be used to invest in profitable ventures. Both the Rab Ul Mal and the Mudharib will agree to a Profit Sharing Ratio (PSR) prior to the start of the investment joint-venture. The profit shared between the Rab Ul Mal and the Mudharib shall be after deduction of management fees and any agreed Profit Equalisation Reserve (PER). Should the investment fail to generate an income or suffers a loss, the Rab Ul Mal shall have to bear the loss of the investment, except when the Mudharib is proven negligent or fraudulent.

AAOIFI’s verbatim Definition of Mudharaba

It is a partnership in profit between Capital and Work. It may be conducted between Investment Account Holders as Providers of Funds and the Islamic Bank as a Mudharib. The Islamic Bank announces its willingness to accept the funds of Investment Account Holders, the sharing of profits being as agreed between the two parties, and the losses being borne by the provider of funds except if they were due to misconduct, negligence or violation of the conditions agreed upon by the Islamic Bank. In the latter cases, such losses will be borne by the Islamic Bank. A Mudaraba contract may also be concluded between the Islamic Bank, as a provider of funds, on behalf of itself or on behalf of the Investment Account Holders, and business owners and other craftsmen, including farmers, traders, etc. Mudaraba differs from what is known as speculation which includes an element of gambling in buying and selling transactions.

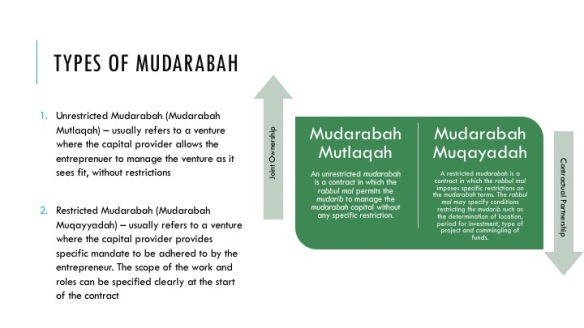

TYPES OF MUDARABAH INVESTMENT ACCOUNTS

There are two types of Investment Accounts, namely:

- General / Unrestricted Investment Account (Mudharaba Al Mutlaqah)

The Investor allows freedom for the Bank to undertake in any Shari’a-compliant investment as he seems fit and within the normal course of business. The funds will be deposited into a General Investment Account pool which will be used by the Bank to manage the funds so long as the investment is made in the best interest of the Investor.

With this type of account, the Investment Account Holder authorises the Islamic Bank to invest the account holder’s funds in a manner which the Islamic Bank deems appropriate without laying down any restrictions as to where, how and for what purpose the funds should be invested. Under this arrangement the Islamic Bank can commingle the Investment Account Holder’s funds with its own funds or with other funds that the Islamic Bank has the right to use (e.g. Current Accounts). The Investment Account Holders and the Islamic Bank generally participate in returns on the invested funds. (AAOIFI 2008)

- Specific / Restricted Investment Account (Mudharaba Al Muqayyadah)

The Bank is given specific instructions by the Investor to invest in a particular Shariah-compliant business venture, where the funds will not be co-mingled in the general investment pool of funds. The funds will be deposited in a Specific Investment Account where the Bank will invest the funds into instruments identified by the Investor as instructed or outlined in an investment agreement.

With this type of account, the Investment Account Holder imposes certain restrictions as to where, how and for what purpose his funds are to be invested. Further, the Islamic Bank may be restricted from commingling its own funds with the restricted Investment Account funds for purposes of investment. In addition, there may be other restrictions which investment account holders may impose. For example, Investment Account Holders may require the Islamic Bank not to invest their funds in instalment sales transactions or without guarantor or collateral or require that the Islamic Bank itself carry out the investment rather than through a third party. (AAOIFI 2008)

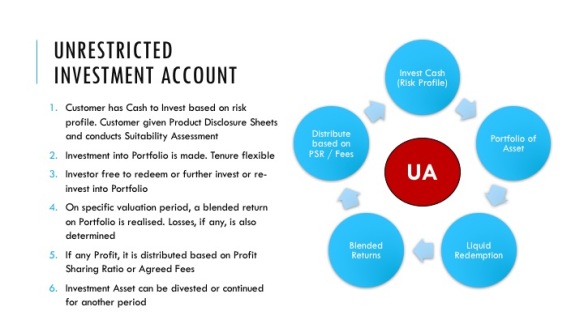

THE INVESTMENT PROCESS

- The Bank, as Mudharib, has the responsibility to prudently invest the funds deposited into the investment pool in low / medium risk short-term investments to mitigate the investment risks.

- The Investor’s fund shall be invested in Shari’a compliant investment instruments such as the Islamic Money Market, Islamic Interbank Investments or other investments such as Sukuks. Alternatively, the funds can be used for Islamic financing of assets, when available.

- Investor specifies the amount and duration of the investment. Both the Investor and the Bank agrees on the PSR at the start of the investment period and may not be changed once the funds are invested.

- Upon maturity, the Bank will divest the funds and make the capital available to the Investor.

- The Bank will declare the profit (if any) for the investment at quarterly investment cycles. The profit to be distributed between the Bank and the Investor, calculated after deducting costs and expenses related to the investment based on the agreed PSR.

UTILISATION OF FUNDS

The funds for the investment pool will invested in selected Shari’a compliant investments with maturities of up to 1 year. The investor agrees to allow the Bank to manage the funds based on the Bank’s expertise and discretion.

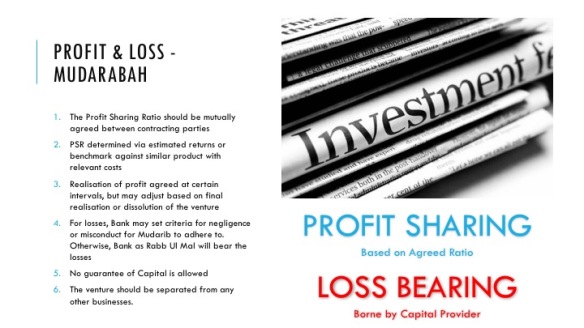

RECOGNITION OF PROFITS AND BEARING OF LOSS

Profit is recognised upon realisation of the investments at the end of each investment cycle and shall be paid to the Investor according to the terms of the individual Mudaraba contract.

Under the BNM Rate of Rate of Return framework, the profit calculation and distribution must strictly follow the format outlined by BNM, via specific calculation templates. This is to ensure transparency in calculation of the profit and its distribution according to disclosed rules. Failure to comply with the methodology will result in stiff reprimand by BNM.

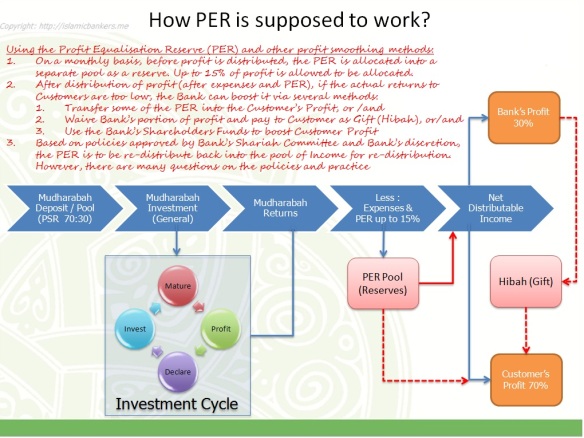

DISPLACED COMMERCIAL RISKS

The idea of Mudarabah and sharing of risks (and therefore sharing of profits) means that the investors gets a return based on actual performance. But Banks (being Banks) always intend to manage the returns to the investments as conventional banks do, which is “fixed”. Because of this, Banks recognised another type of risks for Islamic Banks i.e. Displaced Commercial Risks.

Displaced Commercial Risks simply mean this; the Bank intends to pay an indicative return to customers, but because the returns to the investment / asset was unable to “perform” or pay as expected (real performance), the Bank faced a risk that they are not able to meet the expected returns for their customers. To stabilise the returns on the investments, Profit Smoothing Techniques are used to improve the returns on the investments.

There are 2 scenarios when it comes to Profit Smoothing Techniques. For example the indicative (target) returns on the investment is 5.0% per annum:

- When the actual performance is HIGHER i.e. 6.0% per annum, the Bank will retain 1.0% into the reserves thus retaining a net returns of 5.0% per annum. This 1.0% is kept until re-distributed in the future.

- When the actual performance is LOWER i.e. 4.50% per annum, the Bank will “boost” the returns by 0.50% thus returning a rate of 5.0% per annum to investors. This 0.50% is taken from one of the few reserves available or other sources (explained below).

In general, there are 4 commonly used Profit Smoothing techniques in the market to manage the returns on Mudarabah.

- The use of Profit Equalisation Reserve (PER) where a certain level of returns is deducted from the Gross Distributable Amount. This is the most popular methodology used but also the most controversial one

- The waiver of Mudarib Share of Profit. While Mudarabah operates by a Profit Sharing Ratio (for example PSR of 70 Customer : 30 Bank), the Bank can improve returns by waiving its share of the profits (Tanazul) to improve the overall returns to the customer. If the Bank’s share of profit is 30%, the Bank may waive some or all of its profit and dump it into the Pool of Income to improve overall rate of returns.

- The use of Investment Risk Reserves (IRR). Although similar to PER, IRR is deducted from the Net Distributable Amount and usually used to reduce the returns to achieve stability. The amount may or may not be re-invested into the pool of Income to improve returns.

- Hibah or “Gift” payments from other income sources into the Investment return pool. Where all else fails, there is nothing better than a direct injection of funds into the Income Pool to improve overall returns. Such injection can come from the Retained Earning, Transfer of fund from other Non-Mudarabah Income Pools, or a straightforward “gift” payment from Shareholders Funds.

PROFIT EQUALISATION RESERVE

In the event of loss to the Investor’s investment, the Bank may return a portion of the Profit Equalisation Reserve (PER) in order to stabilise the Investor’s overall returns or reduce the following month’s PER ratio.

There is a general methodology to treating the losses for Investments, with the following steps to be met:

- The loss should first be deducted from any undistributable profits on the investment. This implies to PER.

- Any loss amount in excess of the above to be deducted from provisions for investment losses. This implies the use of any allocated reserves.

- Any remaining amount after the above, is to be deducted from the respective equity shares held by the Islamic Bank and the Investment Account Holders, according to each party’s equity contribution. This implies compensation via Shareholders Funds.

For losses resulting from the Bank’s misconduct or negligence, the following method of compensation must be followed:

- The compensation to be deducted from the Bank’s Share of Profits. This means the Mudharib Fees may end up being zero.

- Any shortfall will be met by Shareholders Funds (equity).

The current scenario (since 2011) is that BNM no longer encouraged the use of PER and has placed strict requirements if a bank wants to use it. As a result most Banks (if not all) have felt it is difficult to comply with the requirements and had now stop using PER as a smoothing technique, especially since the Investment Account guidelines was issued in 2014. To read the Guidelines on PER, click here.

PAYMENT OF PROFIT AND REALISATION OF LOSSES

The profit from the investment will be paid at the end of the investment cycle. The profit from the investment can be distributed based on the following scenario:

- Profit paid on the expiry of the investment contract. Profit and principal will be paid to investor if the expiry of the investment equals to the investment cycle.

- Profit paid after the expiry of the investment contract. On expiry of investment contract, the principal will be returned to the investor while the profit will only be paid once declared at the end of the investment cycle.

- Profit paid before the expiry of the investment contract. Usually applicable when there is interim payment of profit. For example, the investment contract is for a tenor of 1 year, and profit is declared and paid each quarter. The investor can choose to withdraw the profit each quarter and the principal plus final profit will be paid at the end of the investment cycle.

The Bank can choose to pay additional profits to a particular Investor segment but the additional amount must be deducted from the Bank’s own share of profit i.e. the Mudharib pool of profit. It must not diminish the pool of profits attributable to the Investors. However, this method is now no longer encouraged as it is deemed as profit smoothing technique following the introduction of the Investment Account framework in 2014.

PARTIAL WITHDRAWALS

In cases where there is partial withdrawal of the principal, the Bank can provide a reduced rate of return on the amount withdrawn while the remaining portion will be entitled to the full rate of return upon maturity. The calculation of the partial withdrawal profit will be based on the formula for premature withdrawal as above. The total profit will only be payable at the end of the investment tenure.

Salaam Mr. Amir,

I have questions pertaining to the profit calculation among depositor’s of Mudarabah Investment account

1. When we use Monthly Average Daily balance for determining Depositor’s Rate of Return for each deposit category (Using Weighted method), does this imply that Profit accrual for each depositor will always happen at the month end and not on any between days of the month?

2. If I want to accrue the depositor’s profit daily, does that mean I will have to use Daily product balance method. If yes, then how do I arrive at Depositor’s Rate of return?

3. What is the formula we use to calculate each of the Depositor’s profit after we arrive on the Depositor’s rate of return?

Thanking you!!

Regards,

Prashant Vishwakarma

LikeLike

Apologies Prashant, I must have missed this entry of yours.

1. The usual method is daily accrual posted monthly, which gives the same effect as a Monthly Daily Average calculation. We accrued daily based on actual amount. End of the month, the accrued profit is posted.

2. As we usually use daily accruals, the rate we used are most probably the previous month’s declared rate. So we accrue based on this. However at the end of the month, we will calculate the profit amount based on actual performance and declare the rate of return for the depositors. If the declared rate is higher than the rate used to accrue and paid at the end of the month, we make additional profit payment to customer. If the declared rate is lower, we should claw back (reverse) the amount already paid. Generally the rate declared is pretty close to the rate used for the accruals.

3. As mentioned above, we calculate and declare the Depositor’s rate of return based on actual performance of the investment. We will then employ the declared rate to the profit sharing ratio of each customer. Under the new Investment Account guidelines, we are not allowed to manipulate or improve the returns to customer artificially; we have to flow actual returns. So if we have overpaid, we will clawback. If underpaid, we will make additional payments.

Hope that helps.

Amir

LikeLike

Dear Mr. Amir,

Thanks a lot for the response. 🙂

I understood it, but it will be very helpful if you can give an example to support your answers(which can help me understand perfectly), which you usually do..

I am sorry to trouble you on this!

Thanks,

Prashant

LikeLike

Salam Amir,

i used to read your information blog with great enthusiasam.it is one of a kind in islamic banking domain.i really appreciate your efforts.it is such a great help for people like me who is in to product development for islamic banking.i am from india and ours is a startup company.it would be a great help for me if you could provide me your email id so that i can contact you through mail apart from the blog.

Thanking you,

Smitha

LikeLike

Hi Smitha

Thanks for visiting. My email is amiralfatakh71@yahoo.com

Do contact me from there

Thanks

LikeLike

Hi Amir,

Thank you for providing me your contact details.

Regards,

Smitha

LikeLike

Dear Amir,

i was looking for article on Ijarah.couldn’t find anything in your blog site. I have some basic questions in ijara.Can you please help me with that.Read some where that in an operating lease, the lessor normally holds a stock of assets with high degree of marketability to provide to other entities.if that is the case then,the customer will be buying stocks equivalent to a property rental value?.sorry if it is a stupid question.

i didnt understand this fully when i connect this with vehicle financing or leasing an apartment for rental.

Saw something similar in Musharaka contract as well.how can we connect equity shares and Assets such as a Vehicle or Building?

Waiting eagerly for your Reply,

Thanks and Regards,

Smitha

LikeLike

Hi Smitha

For Ijara, the underlying asset is the property or asset to be leased itself. Transaction is using the said asset. It does not require holding of other asset, unlike a Tawarruq home financing (where you trade commodities although you have a tangible asset ie house)

So, under operating lease, the asset traded is the property itself where the customer pays for the right to benefit (usufruct) from the use of property. The bank keeps ownership of the property but lease out the “right to use” property for a certain rental amount. No other assets came into play for Ijara.

Hope this helps

Thanks

LikeLike

Dear Amir,

Thank you for your information.

Regards,

Smitha Menon

LikeLike

Dear Amir,

Could you please provide some insight in to Ijara with Musharaka and ijara with Mudarabha.

Regards,

Smitha Menon

LikeLike

Hi Smitha, not sure in which context you are referring to. Deposits or financing? In an ijara arrangement, the usufruct is rented out while Musharaka and Mudharaba, there is equity inclusion into the arrangement. Can you give me some examples in which context you’re referring to?

Thanks

LikeLike

Dear Amir,

I highly appreciate your quick response.you can consider me as an intern.iam a starter in islamic banking.so pardon me for my layman questions.iam collecting information for islamic product development from web.so getting confused at times.i read some where that ,One of the most-preferred forms amongst all ijara contracts in the realm of housing finance, is the ijara-Musharaka or the ijara-Mudaraba pairing, both the parties contribute to the equity of the partnership in a certain pre-determined ratio.In this case i would like to know the process flow.The customer will be a shareholder and he takes an ijara financing from the bank and we can consider his share as a downpayment ,which he can withdraw anytime.This is my understanding on Ijara with Musharaka or Mudaraba pair.Please correct me on my understanding.

Thanks and Regards,

Smitha Menon

LikeLike

Hi Smitha,

Ok thanks for clarifying. Now I understand you’re referring to financing. Yes, one of the preferred structures by scholars for house financing is based on hybrid of Musyaraka+Ijara and Mudharaba+Ijara. While it is simplistic to envision such strcutures theoretically, putting it into practice is not as simplistic. The Mudharaba+Ijara structure has not been developed in earnest, but there is a basic form for Musyaraka+Ijara in Malaysia which is the Musyarakah Mutanaqisa (diminishing partnership) in Malaysia.The way it is being structured is to achieve a financing result.

In a Musharaka Mutanaqisah arrangement, there are multiple contracts working at the same time. As a start, the process starts with the contracts.

1. A Musharaka contract is entered where the customer and bank agree that each party will contribute principal equity. The Musharakah also states that the customer can/must purchase the equity in the property from the bank over a period of time. And if the customer do not continue to purchase the equity, it is deemed that the customer wants to exit the partnership. To exit the partnership, it means the customer want to/will fully purchase all the equity. There is no profit consideration for this portion (just purchase of equity at par value).

2. An Ijara contract where the Bank earns a return. Theoretically, if a bank and customer enters into a Musharakah arrangement with customer for the purpose of investment, whatever rental amount collected from a third party will be shared between the Bank and customer based on equity ratio. For example, if the Bank : Customer equity ratio is 80:20, it means for every monthly rental collected of RM2,000 from the property, RM1,600 goes to the Bank and RM400 goes to Customer. But in this case, the customer is the lessee (renting the property), so the Customer needs to only pay the rental of RM1,600 to the Bank (RM400 technically belongs to Customer ie Customer paying to himself). Also, as person renting and enjoying the beneficial ownership (usufruct), the Bank and Customer agrees that the Customer is to pay for the utility bills and any assessment payments.

3) Wakalah ie Agency. To maintain the property in good condition, the Bank and customer agree that the customer will become the agent of the Musharakah to do what is necessary to maintain the house. This means repair and maintenance.

4) Therefore, the agreed fixed monthly installments will consist of 2 elements, ie the Rental, and the Purchase of Equity. The Bank can also agree to protect the partnership further by putting a ceiling rate on the Rental portion, for example 10% maximum. It means the Customer will never pay Rental of more than 10% even when the market rate moves above 10% p.a.

5) As the Equity is purchased over time, the partnership is accelerated where the Rental portion becomes smaller and Equity Purchase becomes bigger.

6) There are other contracts that can be built into Musharakah+Ijara (i.e. Musharakah Mutanaqisa) arrangement such as Istina’ (contruction) or Ijara Mausufah Fi Zimmah (Forward lease), Wa’d (promise) and Rahn (Collateral).Depending on the customer’s and Bank’s mutual agreement.

Theoretically, the Customer can withdraw his share of equity anytime, but that means finding another party to purchase his equity. That means the dissolution of the partnership arrangement for the bank as the party is now different, with a dissimilar credit standing as the original customer.

Hope that somehow helps. Thanks

Amir

LikeLike

Dear Amir,

Could you please provide the vedio link on your seminar on Deposits.i had saved it for future reference and alas..it’s missing now from youtube.

Regards,

Smitha Menon

LikeLike

Hi Smitha

Try this link https://youtu.be/kKjj20k9dfY

Or paste the following title onto Youtube

Industry Talk: The Shift of Mudharabah Products into Investment Accounts by Amir Al-Fatakh Yusuf

Good luck. And thanks

LikeLike

Dear Amir,

It was a great help..thank you very much…;)

Regards,

Smitha Menon

LikeLike

Salam.

I am aware that Mudharabah is used in the Islamic interbank money market also. There is one instrument called Mudharabah interbank investment (MII) which the tenor may be overnight up to a year.

My question is, if MII is used overnight (bcs thats what commonly happen), how does the bank(borrower) manage the funds that they borrowed to earn profit since they have to pay back to the lender, also that the instrument is overnight. Bcs the only way to earn fast profit is by trading with insterest, which is haram.

So can you explain on this?

LikeLike

Salam Aqilla,

I am not privy to the exact workings of MII overnight, but generally an overnight arrangement is not necessarily is an overnight investment. It may or may not be that the investment is for a month or more and when a bank comes in for the night, it replaces or takes over the principal of the borrower, therefore entitled to share the overnight return. Usually the portfolio is already an existing portfolio and continuously running, and an overnight placement by a Bank will “temporarily take over” that portion of the profit for the Bank’s amount of investment.

Imagine buying into a 5-year Sukuk portfolio but only for 1 day. The portfolio therefore only pays you for 1 day because you only participate in the portfolio for only 1 day.

Of course the mechanism is not as straight forward as that because MII of GII is usually multi-tenure investment. What you’re doing with your overnight placement is basically “participating” in the portfolio for only 1 day, regardless of any tenure or specific investment because it is an unrestricted and mixed portfolio.

Now, if it is a restricted portfolio, then the arrangement will be different, as you should not be able to enter and exit the portfolio as and when you intend to. Under restricted investment, you need to match tenure and stay until end of tenure, before realising the profit at that point.

But Mudarabah unrestricted works just like a normal bank that has financing and receives customer deposits; it replaces the Bank’s capital with customer’s deposits and the customer “buys” the right to the profit to the deposit for the duration of the customer’s placement. Even if it is for 1 day. This “participation” by customer is actually what happens in the bank on a daily basis, and similarly it happens in a MII or GII scenario.

Hope that answers your question. Thanks

Amir

LikeLike

thank you! that really helps with my question.

Just as you mentioned about the sukuk, sukuk as we know is a long term investment. can we participate into a long-term investment but choose to only participate in a day?

is that just an example, or it is a real thing in the market?

LikeLike

Hi Aqilla,

Well technically YES, depending on the terms of the Sukuk, you can actually buy a 5 years Sukuk today and sell it the next day. But Sukuk is an investment product, and to sell the next day it will be valued based on Marked-to-Market, which may result in a loss (or maybe a gain) because it depends on the market.

Hope that helps

Amir

LikeLike

Dear Amir, in gold investment through Mudarabah how does the mudharib manage the investment as it is act as a commodity not as currency? Is it get the profit/ loss according to the movement of current world market price of gold? Thank You.

LikeLike

Hi Jenn, in its simplest structure, Gold Investment via Mudarabah works exactly how you described. A small manager fee for the Bank, and the customer takes the market movement and performance. Could be loss or gain depending on market. Thats the real investment structure

LikeLike

So the application more towards using Wakalah contract then Mudarabah? And why the application of mudarabah in financial institution become lesser? It is because of the risk? Thanks again.

LikeLike

Hi Jenn, my personal opinion is that the market is more familiar with the concept of Wakalah as it is common when you are used to purchasing Unit Trust (investments). The fee can be agreed upfront and the investors enjoy the market movements. Mudarabah now requires a little bit more of regulatory disclosures and reporting, and despite the structure being around for many years, the concept of profit “sharing” are still look at with a bit of skepticism. Yes the risk is there for the bank as well, especially when market performance is down. As such, Mudarabah is not being favoured by some banks and customers due to the “performance” element of the structure.

LikeLike

thanks brother it helpes me

LikeLike

You’re welcome brother

LikeLike

Pingback: Faydalı lnklər. – Yamin Savalanli

could types terms of mudaharaba fixed time deposit…mediem term when say what year…short and long

LikeLike

Yes you can fix the terms for short and long term deposit. It may even be Restricted Investment where the deposit tenure is matched perfectly.

LikeLike

Is Hiba or Special Profit rate system is allowed or according to sharia compliant principles?

LikeLike

Salam Bro Shoaib

Hibah generally is a gratuitous contract and is discretionary in the eyes of Shariah. It is usually not given as a commitment or promise on a deposit.

Regards

Amir

LikeLike

On customer perspective . which savings bank a/c is better from below;

1- Shari’a compliant Savings account designed based on the principles of Mudarabah

or

2- Wakala investment saving account…

LikeLike

Apologies with the late reply, having problems accessing this site earlier.

From customer perspectives, it really depends on customer risk profiles. If the customer is risk taker then it is the Mudarabah. Otherwise Wakalah is lower risk (but not totally risk-free).

Thanks

LikeLike

what is uses of fund mudarabah , short-term investments?

LikeLike

Mudarabah min use is to cater for sharing of risk investments, mainly in projects or short business ventures

LikeLike

Hi great readding your blog

LikeLike