Profit Equalisation Reserves (PER) has long had its share of critics. While having a noble intention when introduced in the early 1990s, it has evolved into an argument point between many scholars, resulting in many bankers being caught in the crossfire. But before we look at criticisms, lets understand what PER is used for.

WHAT IS PER?

The PER is a mechanism act to mitigate the fluctuation of Rates of Return arising from the flux of income, provisioning and total deposits.

WHY DO WE NEED PER?

The creation of PER is to ensure that Islamic Banking Institutions (IBIs) Rates of Return remained competitive and stable. During times of low returns to depositors and investors, IBIs can choose to utilize the PER to improve and stabalize the Rate of Return to its depositors and investors. The main purpose is to protect depositors and investors interest as far as possible.

WHERE IS PER MAINTAINED?

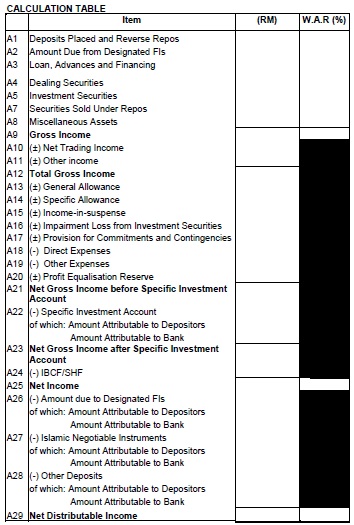

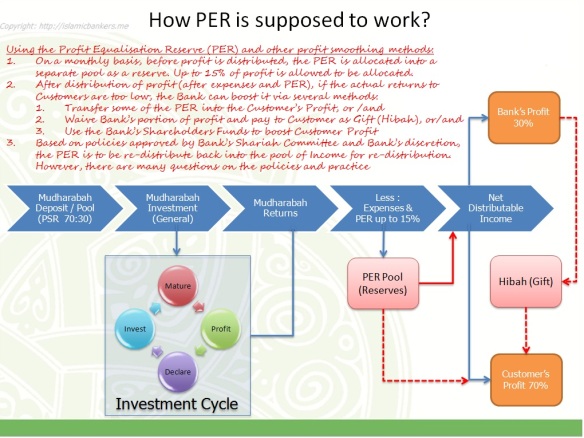

PER can be seen at the profit distribution framework. In Malaysia, it can be seen at the Rate of Return Framework which is maintained by all IBI. PER is appropriated out of the total gross income and it is a provision shared by both the depositors and the bank.

HOW MUCH PER CAN BE ALLOCATED MONTHLY FROM THE TOTAL GROSS INCOME?

PER can be allocated up to a maximum 15% of the total gross income every month. The formula for how much PER can be allocated is as follows:

PER (maximum monthly provision) = (15% x gross income) + net trading income + other income + irregular income such as recovery of non-performing financing (NPF) and write back of provisions.

IS THERE ANY LIMITS ON THE AMOUNT THAT CAN BE ALLOCATED TO PER?

Yes and in Malaysia as per BNM Guidelines, IBIs are only allowed to maintain a maximum accumulated PER of 30% of Islamic Banking Shareholders’ Fund.

WHAT HAPPENS IF IBIs MET THE LIMIT?

IBIs are not allowed to allocate anymore hence have to revise its Rates of Return to distribute the actual profits.

WHAT IS THE MOST CONFUSION WHEN IT COMES TO PER?

Although IBIs are given the right to allocate some of its income into PER, it is not right for IBIs to treat PER as another source of income as most bankers assume. PER is a way on how an IBI can manage or control its Rates of Returns. By right, any income generated from the utilization of funds i.e. depositors funds, must be returned back in full to customers accordingly.

Contributed by : Mohd Kamil Hadsrim Ibrahim

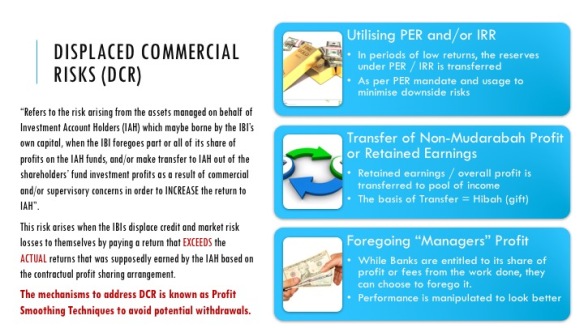

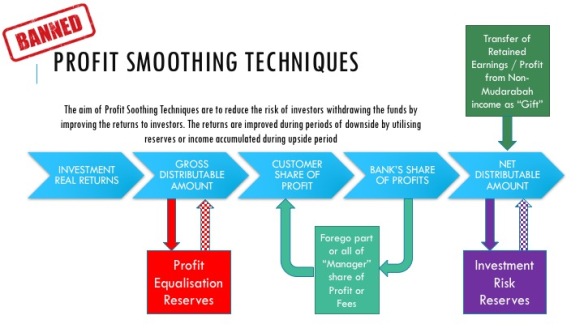

Now for the common criticisms. PER is usually employed under the Mudharaba structures where a certain percentage of the profits are kept aside for the purpose of providing a buffer whenever actual investment returns are running low. This therefore defeats the purpose of Mudharaba, where profit sharing is supposed to run hand-in-hand with loss sharing. Having a buffer that can be used to add to a low-profit removes some of the risks that the investors (or customers) are supposed to have. Utilising your PER means actual performance is muted and covered by the PER allocation.

Now for the common criticisms. PER is usually employed under the Mudharaba structures where a certain percentage of the profits are kept aside for the purpose of providing a buffer whenever actual investment returns are running low. This therefore defeats the purpose of Mudharaba, where profit sharing is supposed to run hand-in-hand with loss sharing. Having a buffer that can be used to add to a low-profit removes some of the risks that the investors (or customers) are supposed to have. Utilising your PER means actual performance is muted and covered by the PER allocation.

Secondly, the payment of PER also becomes controversial. How much can an amount be withdrawn from the PER to compensate income shortages? What is the right amount? Is there a formula that one needs to follow, or is it a Bank’s discretion on how much that can be taken out of PER to boost investors’ profits? Who can make this decision and is it the right decision?

Thirdly, what is the right amount of PER for a Bank to keep on its books? How long should the PER be kept? Can the Bank do anything with the PER? There may be restrictions imposed by Sharia on its use, but like it or not, once the amount goes into the Treasury coffers (in an organisation where the conventional bank has an Islamic subsidiary or Islamic windows), it is difficult to differentiate its movement in the virtual world. If PER is mobilised, should the profits generated by PER be kept by the Bank as this is essentially customers money?

Fourth, the justice of it all. Not all customers will continue to stay in the Bank indefinitely. While the PER is allocated on current customer’s portfolio, the question is that how long should the Bank hold the profit under PER before it is being re-distributed into the common profit pool? Some customers will leave the Bank before this re- distribution, and this means some customers who deservedly gets the PER re-distributed into their account will not get any as they are no longer with the Bank. Instead, new customers who enter may benefit from this enlarged pool of PER. This may be construed as an injustice to the customers who invested but do not get the full returns vs new customers who may get additional returns from someone else’s share of the PER.

LATEST UPDATES ON THE USAGE OF PER (2013)

It is with this understanding that most Banks have moved away from PER beginning 2011, as more and more controls are placed by BNM on how to manage PER. More responsibilities are placed on Banks to ensure fairness to investors when their rightful profit is allocated into the PER. Disclosure requirements, customer’s experience, scholars expectations and BNM scrutiny has resulted in many Banks option to not allocate any PER.

This sentiment is also captured under the Investment Account Concept Paper (2012) and updated 2014 where any methodology to artificially boost customer’s returns is disallowed, including Profit Smoothing techniques in Displaced Commercial Risks mechanisms. This effectively disables the whole concept of PER, since PER was specifically created to cater for Mudharaba and to smoothen the returns to the investors. Therefore, although BNM did not specifically retract the PER Framework, the issuance of the Investment Account Concept Paper will render PER useless. I am not sure if any Malaysian Banks are still using PER, but I foresee PER will eventually be forgotten from the pages of Islamic Banking in Malaysia history.

Do read and provide feedback on what we can feel about PER.

Other readings:

Could any one tell me the drawbacks of using PER please. Thank You

LikeLike

thanks for your article.

LikeLike

You’re welcome. Hope it is of some help to you.

Regards

Amir

LikeLike

this is very useful in my studies as a pioneering student of islamic banking in my country uganda

LikeLike

Hi Mikidad, glad it helps you, if you have any further queries, please ask us. Good luck Thanks.

LikeLike

Reads interesting. Thanks Mr. Amir.

LikeLike

Reads interesting. Thanks Mr Amir

LikeLike

The post is very insightful.

1. Please enlighten us more on the treatment of PER in the banks financials statement. iam aware that the provisioning should not impact liability and not an expense from the MIA reporrt.

2. Can a bank set aside profit for profit smoothening from its own share of the mudarabah profit, meaning that the rab al mal is not contributing to the PER. What can this be called ? or can it still be called PER?

LikeLike

1) in the financial statement, it used to be recorded as “reserves” or “provisions” or some banks recorded it directly as “Profit Reserves”. In a way, it will be having the same attributes as liabilities, the only issue is that the liabilities is not tagged to a particular individual but to a “pool of profit”.

2) Theoretically it can be done ie amount taken directly from the Mudarib’s share of profit. The question is “why”? Back then, PER can take the money directly from Mudarib as and when needed so there is no need to take it up-front and deposited into the pool. Putting the money in the PER at an early stage will result in the bank’s “income” being depressed for the month and that’s not good news for the shareholders looking at the performance report. I guess, you can still call it PER as the function will still be a reserve of you decide to practice it.

LikeLike

Hi, thank you for the write up. To date, what are the current status on application of Profit Equalization Reserves (PER) in Malaysia?

LikeLike

Salam Nur Farzana, PER usage has largely been stopped in Malaysia since 2011. There was a guideline issued on the operationalisation of PER but it is difficult to comply with so many banks have stopped using it totally. Those who still have it in their books are mostly legacy balances that is yet to be distributed / redistributed.

Hope that helps. Apologies for the late reply

LikeLike

If I may ask, PER will easily be applied when it is a restricted mudarabah investment. Incase, of unrestricted, it might be difficult to apportion, trace or identify certain profit from the mudarabah pool.

LikeLike

Salam Ajani, it is true that the unrestricted investment, it is difficult to trace the exact customer from which the profit is taken from, and whether there is a way to redistribute the profit back to the exact customer. This is one of the factors that results in Shariah having issues with the practice of PER

LikeLike

Assalamualaikum,

If there is a system able to identify every single of IAH in unrestricted investment Pool, would be okay to reintroduce PER?

LikeLike

Waalaikumsalam,

Apologies as I just got back my access to my site and responding now.

You are right, potentially if a system is able to do this, PER can be reintroduced to redistribute to the rightful owners automatically. But it kinda defeats the purpose of having a PER in the first place. The whole idea was to profit smooth the returns “manually”. Now, the atmosphere is to just “pay the actual amount”. Why is there a need to smooth profit nowadays, when there are structures that can already pay based on “contracted rate”?

LikeLike

Salaam Amir,

1. Can the PER balance become negative? Theoretically if losses occur on the investments for a long time

2. What happens to the legacy balances you mentioned are still on some banks books in Malaysia? Can they be fully distributed to IAHs?

3. When IAH close their accounts, do they get a share of the PER on departure?

LikeLike

Salam Taofik

1. In general, PER is purely transfer of actual funds from the “profit” into a reserve account. This implies is it a “trust” arrangement after the transfer, and no longer an investment. It should not be negative as it is actual cash.

2. Each bank had made a decision on the legacy amount left in PER. Many took the “best effort basis” to refund accordingly but those where the original investor cannot be contacted, the bank’s Shariah Committee will make a decision on how to deal with it. I am unable to comment on those decisions as it has its own particular deliberations that I am not privy to.

3. No the previous practices that I am aware of, I don’t think there were mechanisms to refund the PER when IAH close their accounts. The PER mandate those days mostly mentioned that PER withdrawals requires specific approval from various committees as part of control. It was never automated.

Hope that helps

LikeLike