Sale based financing has always been a main point of argument between the Bank and Customers. The single matter of “Selling Price” which is a requirements of all Sale-based financing such as Bai-Inah, Murabaha, Istisna’, Commodity Murabaha and Bai Bithaman Ajil, has resulted in many disputes especially in the scenarios of Early Settlement. At any point of time, the Customer will see the outstanding Selling Price of their financing, and as the Selling Price is imbued with the profit to be earned for the financing, this figure is always seen as “expensive” for the Customer.

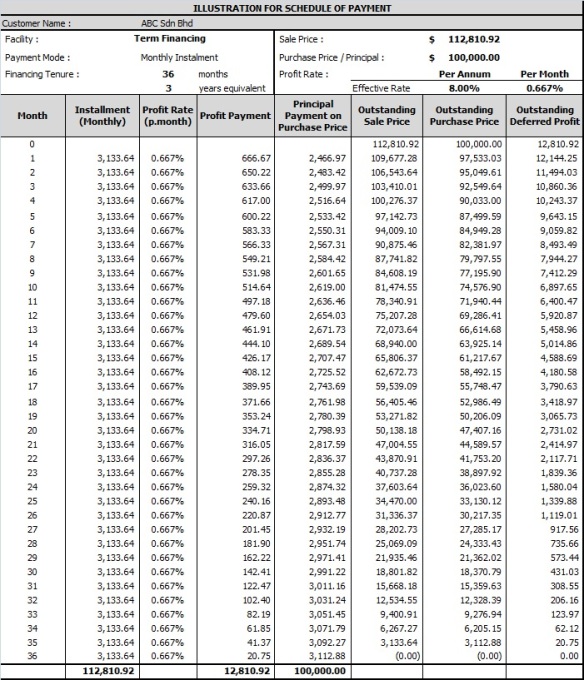

For example a financing of RM100,000 with a 8.0% p.a. financing rate for 3 years. The monthly instalments, whether a conventional financing or Islamic financing, will be RM3,133-64. This calculation is the same for all banking. The main contention is the fixing of the selling price, which is a mere basic formula of RM3,133-64 x 36 months (3 years) = RM112,810-92. Essentially this is the same amount a conventional loan will eventually collect. A grand total of RM112,810-92. The only difference is that under conventional banking, that amount of RM112,810-92 is not fixed as a ceiling, so technically, the customer may end up paying more than that should the base lending rate increases. There is no issue of Islamic financing is more expensive because of this. The maximum amount on the financing that a Bank can collect is RM112,810-92.

But what some customers see is different. For example, for a conventional loan, if the customer wants to early settle on the 12th month, the customer is required to pay off the principal amount outstanding i.e. RM69,286-41. For an inquiry on Islamic product for the same period, the Bank usually informs customer on the outstanding Selling Price (RM75,207-28), which includes the unearned profits(RM5,920-87) for the financing. Of course, for early settlement, we will usually grant discretionary rebate on the Selling Price, which effectively wipes out the unearned profit amounts. What the customer eventually will pay will be exactly the same as what a conventional loan will indicate i.e. Outstanding Selling Price (RM75,207-28) less Unearned Profit (RM5,920-87) = RM69,286-41. With proper understanding of the Islamic product mechanics, you will find Islamic products nowadays are at par with the conventional loans structure.

The requirement to provide Schedule of Payment

Whether justifiable or not, the perception when it comes to calculations for Islamic Banking products, it is felt to be too complicated to understand. Under this new guidelines, the above calculation is now needed to be made clear and transparent. The purpose is to improve understanding of the structure.

Customers must therefore be provided with a schedule of payment, with clear illustration that at any point of time the customer can have an indication of what is the “rebate” (the unearned profit still yet to be earned), provided that the customer follow the schedule of payment (monthly instalments). This is also in line with the requirement that the Banks are now required to provide mandatory “Ibra” under the following scenarios i.e:

- Early Settlement – whenever the customer intends to make a lump sum early settlement, the unearned portion must be waived as a rebate.

- Refinancing – same scenario as Early Settlement, where rebate is on the “unearned profit”

- Restructuring – if the restructuring resulted in the reduction of tenure, the “unearned profit” for the shortened tenure

- Default Settlement – this refers to the point where during settlement (default cases) i.e. the default judgment amount is actually settled by the customers. The Ibra is only given once the amount is settled (provided that there is remaining “unearned profit” not earned yet).

By issuing a “schedule of payment”, the Bank commits the amount of rebate in such instances where rebate is mandatory, and provides a basis of “equal” comparison between an Islamic structure and a conventional loan.

As a matter of clarity on the above, it is also prudent to make distinction to the types of Ibra’ that can be given, into two types:

- Ibra (rebate) arising from the above scenarios i.e. early settlement, refinancing, restructuring, and default settlement, and/or

- Ibra (rebate) arising from the discount given for the difference between the maximum selling price and the price calculated against a benchmark, which is incurred based on certain events. For example, a sale price based on a profit rate of 9% but the seller agrees to provide a discount of 3% on the sale price based on certain scenarios e.g. good payment record, or low funding cost (Base Financing Rate). Therefore the customer (buyer) is paying profit for 6% where he enjoys the rebate of 3%.

The guideline on Ibra’ therefore only applicable for the above item 1, as item 2 is generally still deemed as discretionary (instead of mandatory) in the eyes of the Islamic industry.

Overall, the requirement for the Schedule of Payment is a good step to increase transparency and a useful tool to explain to customer the workings of Islamic Banking product. This guidelines goes a long way to dispel the notion that Islamic products are inherently more expensive than conventional products. The requirement that Bank MUST give Ibra’ for early settlements provide a lot of comfort to the customers and with the Schedule, customers can see exactly where they financially stand at any point of time. It is a good Guideline issued by BNM.

Ibra’ Scenario for Recovery

One of the things to remember is that during recovery stage of a default account (within financing tenure), Ibra’ is to be given only on settlement. Therefore, the Letter of Demand (LOD) issued will be based on “Outstanding Sale Price” and a disclaimer that “Ibra’ will be given upon full settlement” of the default financing. For example, the Sale Price Outstanding is RM200,000 (where outstanding principal with earned profit is RM120,000 and unearned profit amount is RM80,000) therefore the LOD must be based on RM200,000. But once the customer able to make full settlement, the Ibra must be given starting from the base amount of RM80,o00 i.e. outstanding unearned profit.

Ibra’ on the Differential Pricing

The guidelines very clearly outlines the different scenarios where Ibra is given for settlements. However, it is very silent when it comes to the Ibra’ arising from the differential pricing of the floating rate structure between the contracted ceiling rate and the effective profit rate. For example, the contracted ceiling rate = 12% p.a. and the effective profit rate = 8% p.a. The customer will only be charged 8% and the differential amount of 12% less 8% = 4% p.a. This 4% constitute a natural Ibra arising from the floating rate mechanism. I presume, this Ibra is not part of this guidelines.

very useful information. tq

LikeLike

Dear Amir,

I read with great interest your article on Islamic Financing, especially the Ibra.

I have a lingering doubt and I hope you could shed some light.

You’ve mentioned on restructuring of the loan as one of the scenario. Let’s refer to your amortization table above, RM100,000 with a 8.0% p.a. financing rate for 3 years. Let’s assume on the 13th month, I pay my monthly installment and also additional prepayment of eg: RM 20,614.68 towards sale price (principal). The bank will then restructure my loan from the 14th month onwards, The outstanding purchase price from 14th month onwards shall be RM 66,614.68-RM 20,614.68 = RM 40,000. What would be the outstanding sale price after the principal payment of RM 40000?

How do we calculate this?

It is my assumption that in Islamic banking, the selling price is fixed in all circumstances (correct me if I’m wrong). In above scenario, if I made prepayments towards principal, my tenure will get shorter and I do think that the total amount that I’ll be paying eventually in this shortened tenure is far lesser than the selling price (due to unearned Ibra). So, in this sense, the selling price seem to be not fixed but instead reduces when there is reduction in outstanding principal. Is my understanding correct or flawed? It is very confusing. I wish you could kindly explain, with numbers, if your time permits.

LikeLike

Hi Vijay

In general, the Sale Price in the system works basically as follows:

1) The Sale Price is the sum of all the installment. It is a fixed amount for the purpose of formalising the Aqad.

2) The Sale Price reduces based on the amount paid. If installment is paid, the Sale Price reduces by the Installment amount paid.

3) In situations where the amount paid is more than the scheduled installments, the excess amount reduces the principal amount resulting in a lower principal outstanding for the next month.

4) The profit for the following month is based on the lower principal outstanding. This results in the following month’s profit being lower thus the principal paid portion being accelerated if the installment remains the same amount.

5) The net result is that the principal gets paid off faster i.e. tenure is shortened.

To your question, what is then the outstanding Sale Price when additional principal is paid?

You are right on the principal amount i.e. the Outstanding Principal is RM66,614.68 less RM20,614.68 = RM46,000 (slight error on your calculation of RM40,000 above)

As for the Selling Price, the system merely records the full amount as the reduction to the Selling Price.On the 14th month, the Outstanding Selling Price is RM72,073.64. If you made payment totalling RM23,748.32 (ie RM3,133.64 installment + RM20,614.68 additional principal payment), the “new” Selling Price will be RM72,073.64 less RM23,748.32 = RM48,325.32

Therefore at month 14th:

Outstanding Principal = RM46,000.00 (instead of RM63,925.14)

Outstanding Sale Price = RM48,325.32 (instead of RM68,940.00)

I understand your question as you will say that there is another element in the Sale Price where it should be adjusted for i.e. the rebate on unearned profit for the additional principal paid i.e. rebate of the unearned profit for RM20,614.68. It really depends on the system we use; some system are developed to immediately calculated this rebate and deduct further from the Outstanding Sale Price. This will be most accurate.

But many systems are not able to do this and the first impression is that this will result in unfairness to the customer if this portion of profit is not deducted.

The beauty of the Ibra guidelines essentially implies that Ibra must be given and you can only take income which you deserve. Any undeserved profit, due to early settlement or principal payment, must not be taken by the bank. Therefore as long as the principal amount is correctly reflected in the system (which will result in the “right” amount of profit charged subsequently) the Sale Price outstanding remains valid as the above formula.

What will happen is that when the principal outstanding amount eventually = 0, the unearned profit = outstanding Sale Price amount will be “rebate”, i.e. the Sale Price is zerorised as the facility is deemed paid off. The unearned profit portion will be the only amount left outstanding at the end of the “accelerated tenure” and therefore will be written off as rebate (as there is no more principal left and thus any further profit is unjustifiable)

Hope that answers your question.

LikeLike

Hi Amir,

I digged into BNM’s Ibra document recently. In that document, a formula for settlement amount was given.

Settlement amount = Outstanding selling price +Instalments due + Late payment charges – Adjustments on Ibra due to fluctuations of EPR (if any) – Ibra at settlement.

While I understood all the components above, only “Adjustments on Ibra due to fluctuations of EPR” is something which I couldn’t understand.

Is there a formula to calculate it? The same document states that:

” Ibra due to fluctuations of EPR is equivalent to the difference between profits based on EPR & CPR”

Could you kindly illustrate this with some calculation example?

LikeLike

Hi Vijay, that’s a good observation. There is 2 types of Ibra implied by the Ibra guidelines ie one is the daily/monthly/yearly Ibra arising from the difference between the contracted profit rate (CPR) and the effective profit rate (EPR), and the second Ibra arises during early settlement where the future “unearned” income is waived to be collected from the customer as Ibra.

I will write a post on this topic soon with some illustration inshaAllah, if I manage to find that time to sit and write.

Thanks Vijay

LikeLike

Hi, Based on your amortization table provided above, I wanted to ask one question.

as you can refer to column “Profit payment” and “principle payment on purchase price”, the total of these 2 column is equivalent to “Installment (monthly)”…

May I know, how the portion for these TWO column been calculated for every month for Islamic financing?

for example, please refer to month 13 row…the monthly installment RM3,133.64 is consist of RM 461.91 (Profit payment) and 2671.73 (principle payment on purchase price)…why not the ratio be RM 400 (Profit payment) and RM 2,733.64 (principle payment on purchase price) or else?

need your explanation, thank you.

LikeLike

Salam Ridhwan

The calculation is based on monthly reducing balance where the month’s profit is calculated by the monthly profit rate multiplied against the principal balance outstanding. This is a standard calculation for monthly principal reducing balances. However, there are no prohibition to change the methodology of profit calculation if all parties agree to the method which is informed clearly prior to entering the contract. It all remains on which calculation formula is acceptable by the parties.

Hope that helps.

LikeLike

As salam, just want to find out, how you get the profit portion of 12,810.92 as based on my calculation : 100,000 x 8% x 3 years = 24,000. Thank you.

LikeLike

Hi Redhawi,

The calculation is based on the annuity calculation (monthly reducing balance) used by most banks for mortgage calculation.

The calculation you mentioned as RM100,000 x 8% x 3years is based on the flat rate calculation used generally by the hire purchase products ie profit is not based on reducing principle but flat throughout the years. 8% p.a. flat rate is around 14% to 15% monthly reducing rates.

Hope that explains it.

Thanks

LikeLike

Hello Brother, do you think, is there any unethical issues in ibra?

LikeLike

Salam Mahmudul Haque, my personal opinion it doesn’t raise any unethical issue if applied correctly. The intention is to bring it on par with conventional banking, but that implies that the practices of conventional banking is acceptable by Shariah all the time. If the practice is to bring it to par to an unacceptable practice, then it is not right. The application must match the right practice, fairly and justly.

LikeLike

Assalamualaikum sir, may i know you reference?

it is from BNM or AAOIFI?

thank you

LikeLike

Salam

Generally I am focusing in BNM guidelines for my writings, not so much reference on AAOIFI standards. My writing is now mostly focusing on Malaysia’s perspective, not so much on middle-east as I have left my job in the middle-east in 2011.

Thanks

Amir

LikeLike

Dear Amir,

First, Jazak Allhu Khairan for this great forum / website which would help many students, researchers, and ordinary people to learn more about islamic banking and finance.

Second, I have become very interested in Ibra’ as an Islamic Finance Tool since it was introduced to me by CIMB S&P contract for my apartment. However, such Ibra’ was to be administer at the discretion of the Bank. Meanwhile, Bank Nigara Malaysia have acknowledged Ibra’ as an Islamic Finance Tool along with the Guidelines that you’ve mentioned above back in 2010, but until now all islamic Financial Institute in Malaysia still administer Ibra’ at their discretion.

Can you please elaborate further on this, and explain why the Islamic Banks of Malaysia don’t totally abide by Bank Negar Guidelines of Iba’?

and would Haidya be the alternative of Ibra’?

Thanking you in advance

Tarek

LikeLike

Hi Tarek, I am surprised to hear this, as of 2013 with the introduction of the Islamic Financial Services Act 2013 (IFSA), all policy documents become law. Under the 2011 Guidelines on Ibra’ (Rebate) on Sale Based Financing, the Ibra is mandatory to be given. The last 2 banks I worked with do not put Ibra as discretionary, and mandatory instead. Perhaps there are a couple of scenarios where Ibra does not apply ie the Islamic contracts used is not sale-based contracts, and secondly, there are some other actual costs that is incurred that the bank needs to recover from an early settlement scenario. Each sale-based document must have an amended clause to state the Ibra is mandatory. Perhaps as well your CIMB document was issued prior to 2011, and may not have the “mandatory” clauses. There should be some sort of notification or supplemental letter. But if in doubt, do give a call to CIMB for clarifications as I am sure they are also treating Ibra as mandatory. But do share with us if you find it otherwise, as I am also interested to know why not…

Regards

Amir

LikeLike

Assalamualaikum,

Thank you very much for this forum. I’m currently doing my PhD in Islamic Banking and Finance in the International Islamic University of Malaysia, I would like my thesis proposal to be regarding Ibra’. I believe Ibra’ is a tool designed to provide the debtor ease in settling debts as it had been mentioned in countless hadiths, and verses to exonerate and expedite debts when debtors are having difficulty paying debts. With the ongoing pandemic it is clear that debtors are in difficult times, I would like my research paper to contribute to that, what improvements do you think can be made to ibra’?

JazakAllahKhayr. Walaikumussalam..

LikeLike

Dear Amir

what is your intake regarding ” Hadiya” practiced by many of Arabic Islamic Banks such as Kuwait Finance House and others to rebate against early settlement of loan ( Contract )?

LikeLike

Salam Tarek

I think the spirit is the same as the Ibra (rebate) practised in Malaysia. Both concepts are discretionary but given for the benefits of the customer. It is generally a motivation for the customer to settle their debts early, which is greatly encouraged in Islam anyways.

That’s my simple view on the idea.

Thanks.

Amir

LikeLike

as salam sir.. thanks a bunch for sharing ibra but need ur expertise.. how to explain if customer ask me what is ibra? in short… summary.. seek your advice urgently. asap.. please..

LikeLike

Hi Miss Rina

Simply put : Ibra is the amount of profit that was contracted (in the Aqad) to be collected in the future, but is now waived (not required to be collected from the customer) due to the early settlement / pay-off NOW.

That means whatever we collect, it is only the profit up to the month it is currently due, and NOT any future profit which we should not earn. We can only earn profit up to the day of settlement.

Therefore, the settlement amount is = the balance of principal outstanding, plus any profit already due but not paid yet, plus any fees still outstanding. This amount is similar to what a conventional bank collects for early settlement, excluding any early settlement charges imposed by conventional bank (but is not allowed under Islamic banking).

All the future profit (which is not yet due or earned by the bank) is the Ibra.

Hope that helps

Amir

LikeLike

assalamualaikum sir, I just wanted to ask how do we get the profit margin in your calculations?

LikeLike

Hi Insirah, profit margin are generally derived from both the internal costs borne by the bank, and market forces.

Internal costs includes cost of acquiring deposits, expenses that the bank have to bear to operate business, and earning required to continue future growth. The business have to be sustainable while being competitive with other banks.

Market forces also determines the profit. You have to price your profits competitively to a rate that customers are willing to pay, and in comparison by other banks. If you price too high, customers will not bank with you. If you price too low, you take the risk of low return to pay your depositors and eventually your competitors will reduce their price and you lose your competitiveness.

In the market nowadays, you can’t price your rates excessively anyway. The competition is too great and consumers have only a certain level of tolerance to the price they are willing to pay.

LikeLike

I noticed that some Islamic banks offer their package on flat rates (say 4.75% flat) but maintain the account on EPR (amortization) formula (8.30% pa). The calculation methodology of these two formula is not the same. Issues will arise if there are early settlement or default. My stand is firm. If the financing is quoted on a flat rate, it must be maintained by flat rate methodology. Similarly with EPR based financing. What’s your opinion on this?

LikeLike

Yes I agree, obviously. It is confusing to intermingle both of them. But the problem is that a great number of the public knows one or the other. Thus banks try as much as possible provide the “rates equivalent” to help the understanding on the rates, but did not provide understanding on the methodologies. It is up to customers to figure out which one of the rates appeal to them, and hopefully they understand the relevant method of calculating the profit for the various methodologies.

LikeLike

Hi sir are there any disadvantages of Ibra?

LikeLike

Hi Wong,

At the moment, I do not see any disadvantages especially for the customer. It also helps the bank to remove potential complaints and conflicts by having a clear regulation. The Ibra guidelines actually brings the Islamic Banking products to be on par (or better) with conventional products.

Hope that helps

LikeLike