2015 promises to be an interesting year as the IFSA 2013 comes into effect for Malaysian Banks. We will finally see that shift in the industry as the 30 June 2015 deadline approaches where Banks will draw the line in the sand, separating their Current Account / Savings Account portfolio into the following:

- Banks that will migrate their Mudharaba deposit account into either a Wadiah deposit account or Qardh account

- Banks that will convert their Mudharaba deposit account into Mudharaba Investment Account

- Banks that will introduce a totally new structure to the Mudharaba deposit customers, such as Tawarruq deposit or something fantastical.

The push by Bank Negara Malaysia (BNM) is really quite clear; Mudharaba as the flagship product that introduces the customers to the world of risk-taking and therefore, potentially higher returns. And if the Mudharaba is to be classified as an Investment Account, then it should behave as one.

But in all honesty, Mudharaba has always been an “investment or entrepreneurial” contract. Worldwide, the concept of Mudharaba means; take customers funds and enter into an investment and share the profits (if any) and should there be a loss, the customer will take that capital losses. This definition does not change, post-June 2015 when the IFSA for deposit comes into effect.

What has changed is that Mudharaba will now be classified as Investments, instead of investments that behaves like a Deposit. There is no fundamental difference between the “now” Mudharaba and “future” Mudharaba. The clause where the capital investment of the Mudharaba is open to potential losses has always been there. The terms and condition contains this. But due to the classification of Mudharaba as Investments post-June 2015, the treatment on how a Mudharaba Investment is processes, managed and executed now changes.

Under a Mudharaba Deposits, the following happens:

- Customer comes in as an Investor, and sees the historical returns on the deposits

- Customer enters into a Mudharaba contract, which allows the Bank to manage the funds on a pooled basis on predetermined terms

- Bank deposits the funds into a managed General Investment pool. Bank will manage the allocation into the financial assets according to Bank’s investment direction

- At a determined period, or maturity, the Bank calculates and accrues the “distributable” profits to the customer

- Bank distributed the profit to the customer, based on the individual Profit Sharing Ratio.

But what happens if the Mudharaba must now behave as an Investment? The process looks very similar to how you onboard a customer as an Investor in a more sophisticated product, such as Unit Trusts or Structured Investment products, or even equity shares on the stock exchange. Notice the types of product that the Mudharaba is now being aligned to; higher risks, specific investments, strategy allocation as well as potentially higher returns, depending on the prevailing market conditions,

So if Mudharaba Current Account or Savings Account is to be deemed as Investments, the following must happen:

- Customer comes in as an Investor, and must come with their eyes wide open. They will see the historical returns on the investments. Customer will also be informed of where their Investments are being invested into and the risks and potential future rewards of the investment. Both for worse case and best case scenario of the investment. This includes the part where the risks to their capital must be clearly be made known to them.

- Customer understands the risk and is evaluated via the Investment Suitability Assessment. A risk grading is assigned and the customer is presented by a list of Investment that their risk grading qualifies for.

- Customer, with all the information available to him, makes his own decision to either enter into a Mudharaba Investment contract for the “right” Investment, decline it, or chose to undertake a higher risk profile Investment with the indemnity to the Bank.

- Bank takes the customer on as an Investor, and invest the funds into the “specific” Investment Asset (This makes the Bank sound like it is now a Fund Management company!!!). The Bank now manages the funds as a Specific Investment pool. If re-allocation of asset in this pool is required, the Bank is to inform the investor of the change in the portfolio.

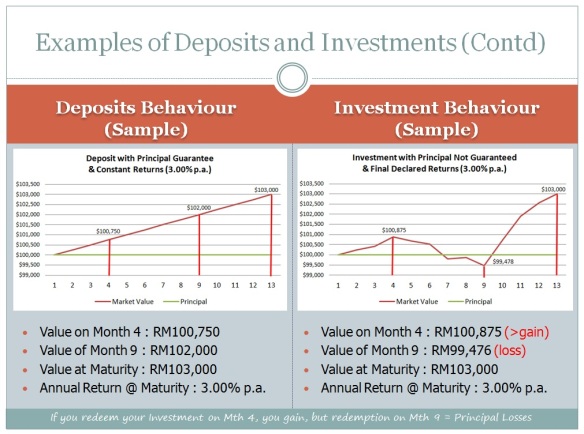

- At a determined period, or maturity, the Bank calculates and accrues the “distributable” profit to the customer. If the Asset is an external investment, there will be a “market value” to be calculated (Mark-To-Market) and any early redemption may result in loss of capital/equity. In some cases, profit needs to be “realised” to be “distributable”.

- Bank distributes the actual realised (or accrued) profit, if any, to the customer based on the individual Profit Sharing Ratio. The investment is either divested based on prevailing market value, or re-invested into a new tenure with new investment terms or parameters.

So you see, the Mudharaba now is defined closely into what a real investment is; capital not guaranteed, returns based on risks, and real valuation. Some will even carry redemption risks i.e. loss of capital if redeemed before maturity.

As a start, the Mudharaba Investment Account, migrated from a Mudharaba Current Account or Savings Account, will now carry their own risk profile, depending on the portfolio of the Investment Assets. It can now be categorised into:

- Low Risk Investment Account – suitable for short term arrangement, with low returns instruments

- Medium Risk Investment Account – suitable for a diversified portfolio

- High Risk Investment Account – suitable for a targeted investment expecting high returns, and volatility

Therefore, even for a basic Current Account or Savings Account, once it is converted into an Investment Account, carries some degree of risks post-June 2015. For one, the PIDM cover will no longer include Investment-type of accounts, and while there are questions of its applicability in its current state, the comfort of such cover is now lost to the daily consumers. Having said that, ideally the Banks should reinforce the idea that with higher risk there should be higher returns. Living in the old thinking that Investment Accounts are the same as Deposits Account (Savings or Current Account) will only result in a disconnect to what BNM is trying to do.

The idea of Investment Account is not only limited to Mudharaba-type of contracts. Any contracts that carries an element of risks to the customer’s capital will be classified as Investments. The on-boarding treatment of customers into these contracts will be the same; The risks of the investment must be made known to the customer, customers must be assessed to identify the risk profile, customers must make their own decision on the risks that they are willing to take, and enter as a real investor taking real market risks. Such contracts will include Wakala Fi Isthihmar (Investment Agent) or Musyaraka (Partnership).

As a summary, what will happen in 2015 once your Mudharaba-type of account (Savings or Current Account) be converted into an Investment Account?

Yes some change will happen, and Banks will be looking to seek customers consent whether to allow the conversion into an Investment-type of account, with the additional disclosures and risk warning statements, or to convert the account into a deposit type of account. As I see it from the Bank’s perspective, the management of the funds in the account remains largely the same, with greater level of transparency needed in terms of where the customers funds are invested into (the Investment Assets), the management of returns and valuation of the assets on maturity or early redemption. Sounds complicated, but really it is not. It is business as usual for the Banks, with some additional reporting, management and compliance requirement to adhere to.

Personally, when the Mudharaba account migrates, I do not foresee a significant increase in risks to the customer capital (as it will still be managed similarly as before) and no significant increase (or decrease) in returns on their “investments”. If the Bank keeps the Investment Assets as “low risk”, there should not be any concerns to the average customers.

There will be other options available to the average investor, but the purpose of this post is to highlight to the existing “investors” that there is no panic button to be pressed. There will be a period of awareness building (reinforcement, more likely) on what “future” Mudharaba is all about, in the stricter understanding of its investment nature. But all this while, the Mudharaba structure is already being managed as an “Investment” via the General Investment pool.

The investment risks have always been there, but because the pool has been managed properly and successfully by Banks, it has become Urf’ (customary) to the customer to believe that capital is protected (when actually it should not). It really is not, as Mudharaba is always an Investment arrangement, and is reflected even in existing documentation and product terms & conditions. Now it may look like it is going to be a different animal in June 2015, however if you take a step back, it is actually an increase in disclosures to the customer on the product features; nothing more. Internal banking processes will be adjusted and enhanced to meet the additional disclosure requirements.

Investment Accounts may seems like a huge change, but it is actually a refinement of the contract requirements. It provides greater transparency to customers, and enhance their involvement in the product by understanding the risks undertaken. The definition of Investment Account has already been captured in organisations such as AAOIFI, where Investment Account and its treatment are defined. BNM is now taking steps in the same direction.

Investment Accounts may change the way you bank at the moment, but it really is a similar proposition to the Mudharaba Deposit account with eventually greater transparency and disclosure. We look forward to welcoming Investment Accounts into our midst of products available.

Very informative article, if somehow you want your bank employees to be more knowledgeable in Islamic Banking, have them enrolled on courses such as.. Certified Islamic Banker there competence level in islamic banking will increase after they finish this course.

LikeLike

Thanks Agapito. Ideally, readers should continue to enhance their knowledge as the more they learn about Islamic Banking, the more they realise the need to support the industry.

LikeLike

Will smoothing practices (allocating reserves in PER and IRR) be discontinued after June 2015? Or will the bank maintain them despite these changes take place?

LikeLike

Salam Sharmila

Yes the profit smoothing techniques will be discontinued after 30 June 2015. Once the creation of the investment pools are done, the Banks are expected to pay real, actual returns on the investments

LikeLike

Will this also means there will be no such thing as Displaced Commercial Risk anymore?Since that is the purpose of such reserves in the first place…

LikeLike

Displaced Commercial Risks are usually present in risk-sharing contracts such as Musyaraka (partnership), Wakala Fi Istihmar (agency for purpose of Investments) or Mudharabah (profit sharing entrepreneurship). There is always a “want” to pay a certain return to meet the expectancy of the fund provider or partner to ensure the funds or arrangement continues and not terminated or cancelled. This is where the need to manipulate the returns comes in; resulting in Displaced Commercial Risks.

The three mentioned contracts are now defined by BNM as “Investment” categories and falls under the governance of the Investment Account Guidelines last issued in 2014. In the guidelines, it is specifically mentioned that the profit-smoothing techniques to address Displaced Commercial Risks are now NOT ALLOWED. Banks are to ensure they comply to this no later than 30 June 2015.

Hope that clarifies, Syarmilla.

LikeLike

Hello.

First of thank you very much for all the informative posts you share. I have been reading your blog with great interest.

In regard to the above post, could you please elaborate further on the background of why this kind of regulatory change was implemented? Was it BNM who simply wanted a clearer distinction between products (and to further develop Islamic investment accounts as separate products), did the PDMI also push for this as they did not see fit to guarantee principals of accounts that are not even guaranteed by the banks themselves, or does this have shariah compliance implications in it (that there should be no guarantee on investment accounts in any form)?

LikeLike

Hi Jean,

Thanks for your question.

I believe the main motivation of why Central Bank has re-looked at all th existing contracts, including the Mudharabah contract, is to capture the actual spirit of the contracts, as it should be. While encouraging innovation, Central Bank is also pushing for alignment to the basic tenets and intentions of the contract. The Mudharabah, for example, is essentially an entrepreneurship contract and therefore closer to an investment arrangement instead of deposit. The guidelines aims to capture this holistically.

Whether it could be operationalised effectively, will depend on each institutional capabilities.

As for PIDM, definitely this is not a push by them. This move to Investment Account (where most big banks has started to move into) means loss of revenue for PIDM. Their hands are tied as the regulation only allow them to “insure” only deposits; by moving to investments, PIDM can no longer cover these portfolios.

There is no Shariah blockage to stop a Mudharabah structure to be guaranteed (for example by a third party), provided the structure can be introduced which meets all the shariah criteria. There are ways; up to each bank to find it.

LikeLike

Amir,

Thank you very much for sharing your insight.

With all this in mind, would you argue that Islamic banks may lose part of their deposits (that would be classified as investments now) to funds or other asset managing firms, or will banks come up with attractive enough offers fast enough to prevent any outflow?

I calculated based on the balance sheets of 6 (‘major’) Malaysian Islamic banks that the percentage (in terms of total customer deposits) of mudharabah and wakala deposits went down from approx. 70% in 2013, to 7% in 2015/6. I think a big portion of this decrease is due to automatic conversion into wadiah or commodity murabaha accounts which still are under the protection of the PIDM.

Though, can we expect Islamic bank customers to slowly move part of their savings back into investment accounts at Islamic banks (rather than for example taking excess savings to securities firms)? Or are we looking at a new period where most clients will simply leave their money in wadia and commodity murabaha (maybe later qard as well) accounts and hope for hibah or. attractive commodity trading profits?

LikeLike

Hi Jean,

It is without doubt that the huge drop of Mudharabah deposits resulted from the forced conversion into Wadiah. On average, it is estimated that the industry conversion is about 7% (and your estimates is correct!!!) and it will take time for these figures to increase. The hard fact is that most customers are seeking CASA equivalent products, not Investments. The customer profile has therefore become unsuitable for Investments. More importantly, at 30 June 2015, only 5-6 banks were able to come out with an Investment account which complies with BNM requirements. The rest is still moving and developing their structures, where their deposits are purely reliant on Wadiah. Now, it is interesting to see the impact of the conversion of the Wadiah into Qard by 2017. We would see then where the money flows to.

The industry is expected to remain in a state of flux while all these standards are being issued. The other alternative is of course Commodity Murabahah but that also poses its own challenges.

Interesting times ahead.

LikeLike

Thanks Amir for your insights.

In relation to DCR, what are the alternative (in a point of view as a banker) to mitigate DCR since smoothing techniques are technically probihited by Invesment Account Policy endorsed by BNM?

LikeLike

Salam Muhammad

The idea by BNM that DCR should no longer be used as it tantamount to manipulation of returns and attempts to “guarantee” the principal.

Banks have no choice but to provide “performance” returns. Technically, there is no such thing as Displaced Commercial Risk, as it is replaced by Market Risk, Interest Rate Risk and Valuation Risk. DCR happened when there is a mismatch between financial obligation, tenure and actual performance; but in Investment Account, the financial obligation is removed. DCR breaks down under IA.

I know as banks who have been so used to the idea of DCR, this is hard to digest. But if you really take a step back and see Mudharaba as a structure, there really is no more DCR.

But of course, Banks have trouble operating on the premise of uncertainty as it is reliant of actual performance for the payout. Banks still have some minor degree to mitigate DCR, but it is not like before. To control DCR, Banks may consider actively managing the composition of asset in the pool to give a stable return. Banks can also replace some of the assets thats not performing with performing ones for the next period of investment, and revise the Profit Sharing Ratio. This will result in some semblance of risk mitigation familiar by the conventional bank.

But in my view, it is no longer necessary. Having DCR methodology for IA will ultimately defeat the intention of Mudharaba.

Hope that help explain.

LikeLike

Is there any specific changes to legal contracts involved in mudharabah investment account?

LikeLike

Hi Lylia

I am assuming that you are referring to the deposit leg of the mudharabah investment account, and not the financing leg of the structure.

Legal contracts for Mudarabah investment (deposits) have always been in existence in the Terms and Condition of the product. With IFSA 2013 on board, the language after IFSA 2013 remains very much similar to the earlier versions of Mudarabah Investments. If you notice, in the terms and conditions prior to 2013, the language also talks about valuation risks and equity risks, and remained consistent after 2013. What is different, however, is the statements of account to customers, the need to conduct Investment Account Holder risk assessment and determining the risk profile, reporting requirements and treatment of Restricted and Unrestricted Investment. Nonetheless, the legal contracts remains mainly intact whether it is drawn prior-IFSA 2013 or post-IFSA 2013.

Hope that helps

LikeLike